Last Updated on January 27, 2025

[Disclaimer: This is not investment advice and is provided for information only. Investment and speculation is risky and you can lose your capital. Do your own research and consult a financial advisor.]

Value investing is a type of investment strategy where you buy stocks when the price is significantly lower than what you estimate the fair value of the company to be.

The idea is that since price does not equal value, if you are judicious in your purchase you should receive more value than the price you paid.

This concept was pioneered by the legendary Benjamin Graham and made famous by his follower Warren Buffett.

While there are a lot of amazing lessons to be learned from the famous value investors there are two problems with traditional value investing:

- Benjamin Graham incorrectly understands speculation

- Investing is much more difficult in a fiat currency economy

An alternative approach is to use value investing principles but couple them with a better understanding of speculation and the nature of the fiat monetary system.

I call it “Value Investing with Speculative Characteristics.” (Yes, it’s actually a play on Mao).

First, let’s consider how traditional value investing works and why the distinction between growth and value is wrong.

Then let’s look at what value investing gets wrong, why investing is difficult in the current fiat money environment and why you need speculation.

Finally let’s consider value investing with speculative characteristics and discuss how to actually do it.

[Please note this method relies on stock picking, which is not something that everybody is comfortable with. If you aren’t then consider whether you should stick with index funds or managed funds instead. Even if you are comfortable with stock picking, what is outlined below is a high risk strategy. I only allocate a small part of my portfolio to value speculation. The remainder are in defensive investments and managed funds. Remember this is not financial advice and is provided for educational purposes only. Do your own research]

What Is Traditional Value Investing?

Value investing has been best articulated by Benjamin Graham and David Dodd in the 1934 book Security Analysis.

Graham had been investing during the 1920s and into the 1930s and wanted to make a distinction between investing with a consideration of the underlying value of the stock and what he considered to be investing for mere speculation with little regard to price or value.

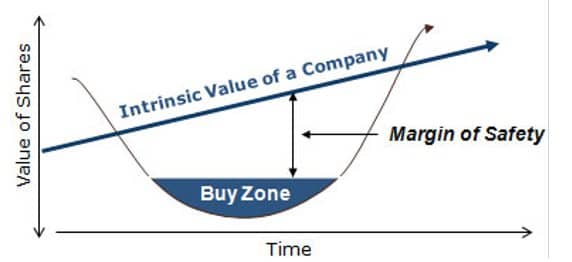

The philosophy recognises that stocks periodically move through phases where the market price is overvalued, fairly valued and undervalued.

Graham’s philosophy suggests that you should look for high quality companies but only buy them when they are undervalued. He argues that you shouldn’t buy a stock for any price and you certainly shouldn’t overpay.

This requires a deep consideration of the fair value of the company. Although not an exact science, there are a number of valuation criteria Graham uses that can help you assess the value of a company.

Graham encapsulates this thinking in the famous phrase “margin of safety.” If you buy a quality stock when it is undervalued, it may fall but it shouldn’t fall too far. If you hold it for long enough then it will eventually revert to the mean and move back towards fair value.

Conversely if you overpay based on value the stock might go up, but there is little margin of safety if you are wrong. If it reverts to fair value, then you will lose money on your investments.

Graham’s other most famous contribution to investing literature is the concept of Mr. Market. Mr. Market is your emotional irrational friend who everyday offers to buy or sell you shares at wildly erratic prices. You are free to engage him or free to ignore him.

Sometimes Mr. Market will offer to sell you a great company at a cheap price and you might choose to buy. Sometime later Mr. Market might offer to take that same company off your hands for a wildly overvalued price and you might accept that offer. But most of the time you can safely ignore him and just hold patiently.

In a nutshell, value investing requires you to know both the price and the value of a company and invest only when you pay less in price than the value you receive in return.

Read More: 22 Things Benjamin Graham’s Value Investing Principles Taught Me

Value Investing vs Growth Investing: The False Distinction

You will often hear it said that value investing and growth investing are opposing strategies.

You will also often hear it said that value investing is dead and outdated and that growth stocks are the only game in town.

Both assertions are false.

The mistake is often made because people don’t truly understand what value investing is. They falsely believe that value investors only look for stocks with low price/book, low price/earnings and high dividends.

You could find a stock with all those attributes but it might be cheap for a reason and it might not offer good value.

Conversely a high price/book and high price/earnings does not automatically mean a stock is not attractively valued.

Additionally, the prospect of growth is a component in the calculation of value so its not a binary case of one or the other.

Typical so called “growth” stocks can also be valued and they will either be above fair value, at fair value or below fair value. The expected growth in their earnings will be “priced in” by the market.

If you can purchase a so called “growth stock” that is expected to have significant growth in earnings for below fair value then you are actually engaging in value investing. If you purchase that same stock for more than its fair value, then you are taking risks.

So in this way, it is fair to say that growth investing as it is commonly understood doesn’t actually exist.

Even if you do look at investing strategies from the false value vs growth lens these strategies are cyclical. At certain points in the business cycle value investing outperforms. At other points in the business cycle so called growth investing outperforms.

It’s not that you can’t make money with so called growth investing, it’s just that according to the Benjamin Graham philosophy it is unwise because it carries significantly more risk.

So if any “growth investor” tells you that value investing is dead know that they will be forced to change their tune eventually. We have been in a so called “growth cycle” for the last decade, which is why you hear this kind of nonsense, but even according to this way of thinking it is likely that the next decade will be a so called “value cycle.”

What Benjamin Graham Gets Wrong About Speculation

Graham defines an investment as something “which upon thorough analysis promises safety of principal and an adequate return.”

To him, if you don’t do a thorough analysis and you don’t buy with a margin of safety, then you are speculating.

Graham’s interpretation has become the mainstream view of speculation. Speculators are viewed as people who who take high risks to make a quick buck.

What Graham gets wrong is the word “promise.” There is never any promise of safety of principal and an adequate return.

All investment is speculative. The so called value investor and the so called growth investor are both speculating, just with different degrees of risk.

This is the argument Ludwig von Mises makes:

“There is no such thing as a nonspeculative investment. In a changing economy action always involves speculation. Investments may be good or bad, but they are always speculative.”

My point here is that you should embrace investing as speculation. Shake off the mainstream view of speculators as gamblers and recognise that you can speculate with a solid Benjamin Graham fundamental analysis.

Buying an overvalued stock merely in the hope of selling it at a higher price has no margin of safety. And this type of speculation, when done with no consideration of value, is certainly misguided.

But if you buy undervalued stocks, but ones with explosive potential and that pay a dividend, you get the margin of safety that comes with value investing while speculating that the stock will not only return to fair value but will eventually become overvalued. At the same time you can pick up a healthy dividend yield on the cheap and watch that yield grow over time.

In my view this is how the great John Templeton operated.

Why Investment Is More Difficult With Unsound Money

Value investing is much more difficult in a fiat money environment and gets more and more difficult the more aggressive the debasement of the currency.

As Saifedean Ammous notes in The Fiat Standard:

“Because of the inflationary nature of fiat money, everyone now has to take risks with their capital to generate a return or else see it melt away.”

In a sound money environment, individuals and households are incentivised to save by attractive market interest rates.

Saifedean again:

“With hard money, children could save for adulthood, and adults could save for retirement; they could expect their money to maintain and even gain value. Saving did not require any expertise or effort.”

With a hard money standard businesses also borrow at market interest rates and thus have to invest prudently.

Government spending is restrained and central banks don’t blow bubbles. Economic growth is driven by savings and investment not consumption.

In this environment traditional value investing methods work well.

In a fiat money environment individuals and households have very little incentive to save because of the debasement of their currency, so they consume instead.

This lack of savings doesn’t matter to businesses looking to borrow, since they get their finance on cheap Federal Reserve credit.

Government spending is not constrained by taxation and is also financed by credit. Consumption is glorified as the driver of economic growth.

All the expansionary credit flooding the economy bids up the price of assets, with stocks and real estate becoming very expensive. In this environment value investing is possible but is much more challenging, because by traditional metrics almost everything is overvalued.

Additionally to earn a real return you need returns higher than the rate of inflation.

In a sound money environment investment is financed by savings.

People are incentivsed to save by market interest rates and those savings are available for business expansion, also at market interest rates.

Money is more expensive to borrow because there is a limited amount of it but this leads to more sustainable growth as the growth is based on real savings.

For your average saver it makes a lot of sense to be conservative with your money and keep it in a savings account. Whether that is a young person saving for a house, a family trying to get ahead or a retiree trying to earn an income. You can always be a bit more aggressive if you want but you at least get a decent return out of the safe and conservative option.

If you do choose to invest in stocks, a sound money environment means traditional valuation measures work quite well. Price/book and price/earnings will be helpful metrics because you don’t have a lot of paper money bidding up the price of stocks. Good businesses will survive and thrive while bad businesses will go under.

In the current fiat money environment an abundance of currency has led to a period of artificially low interest rates. Individuals and households are not incentivised to save because there is very little point with such low rates, so they consume more instead. What’s the point of delaying gratification through saving if your money is worth less in the future?

Business doesn’t need to rely on savings to finance their investments as that can be done on central bank credit. This is especially the case for large corporations who often have access to cheaper lines of credit than mom and pop businesses.

All the currency that the economy is awash in needs to find a home somewhere, so it flows into real estate and the stock market, blowing a massive bubble and leading to extremely high asset prices.

Saifidean Ammous describes the socially destructive force of fiat currency in The Bitcoin Standard:

“The move from money that holds its value or appreciates to money that loses its value is very significant in the long run: society saves less, accumulates less capital, and possibly begins to consume its capital; worker productivity stays constant or declines, resulting in the stagnation of real wages, even if nominal wages can be made to increase through the magical power of printing ever more depreciating pieces of paper money.

As people start spending more and saving less, they become more present-oriented in all their decision making…

Rather than witness their savings accumulate and raise the capital stock, this generation has to work to pay off the growing interest on its debt, working harder to fund entitlement programs they will barely get to enjoy while paying higher taxes and barely being able to save for their old age.

This move from sound money to depreciating money has led to several generations of accumulated wealth being squandered on conspicuous consumption within a generation or two, making indebtedness the new method for funding major expenses.

Whereas 100 years ago most people would pay for their house, education, or marriage from their own labor or accumulated savings, such a notion seems ridiculous to people today.”

As an individual what do you do?

Saving makes little sense, since you get next to no interest and inflation will eat your capital.

Investing in the broad market through index funds makes some sense but also comes with risk. You can’t sit back and miss out on the stock market rally but you run the risk of being caught holding the bag if you buy near the top and the market turns.

You need a place to live, so you could buy a house. But only if you can find the deposit and can service the mortgage. If you can get the massive deposit you might able to service the mortgage on current interest rates. But what if they rise?

It’s risky to not buy real estate as rising prices put a home further out of reach. But at the same time it feels risky to buy as it’s impossible to tell what is going to happen to interest rates over the lifetime of the mortgage. If they do eventually rise, and rise significantly, then home values might drop and servicing the mortgage will become increasingly difficult.

That’s where value investing with speculative characteristics comes in.

It’s not a silver bullet, but it can help in a market where it feels every move is a risky one.

Speculation As A Defensive Move

Benjamin Graham would see speculation as an aggressive move that, while not necessarily a bad thing, carried a lot of risk.

But in this environment one the biggest risks one can take is to sit on cash in a savings account and watching inflation destroy it. Doing nothing is not an option.

Investing becomes necessary by default and the question becomes how to do it safely and effectively.

This is where Doug Casey’s insight is particularly helpful, as he sees speculation as something both necessary and defensive. Understanding why this is the case is very helpful because you can then go after defensive speculations with the right mindset.

First Casey notes how inflation leads to chaotic markets:

“If inflation goes much higher, especially in an environment of artificially low or suppressed interest rates, nobody is going to save dollars for the same reason Argentines don’t save pesos.

People will instead redouble their consumption, acting more and more like foolish grasshoppers and less and less like prudent ants.

The result will be a dearth of capital. Lots of currency, but no capital, will gradually transform the US into Argentina or Venezuela. Innovation will diminish. Technology, which lives on capital, will slow down. Among other things, it will result in chaotic markets.”

Then he describes how chaotic markets discourage investment:

“In this economic and political environment, “investing” is a poor option. Investing can be compared to the planting of a seed in order to grow an ear of corn. It requires proper conditions in order to succeed.

Investing capital requires certain minimums of stability and predictability. Those will be in short supply, along with many other good things. Markets will be going up and down wildly, like an elevator with a lunatic at the controls. That discourages investors.”

And finally how speculation becomes necessary in response:

“Speculators, on the other hand, look to prosper in chaos. They don’t try to grow businesses; they just take advantage of politically caused distortions in the market. That’s why they have a bad reputation. But it’s an undeserved reputation since they’re just reallocating capital in the face of chaos—which is necessary and salubrious.

In a stable free market, speculators would be largely unemployed—but unfortunately, that’s not the world we live in. You’re going to have to learn to speculate. In the highly politicized environment we’re facing, there will be plenty of purely psychological panics to the downside and manias to the upside as well.

The bad news is that in an increasingly inflationary, heavily taxed, heavily regulated society such as ours, the general standard of living will decline. One has to become a speculator out of self-defense.”

The traditional idea of speculation as a way to take a punt on making big money still holds true. But done well, with a cautious value investing lens, speculation can be a way of protecting and growing your wealth.

Because as John Templeton notes, an investor should always be mindful of his or her real returns, not just nominal returns. That means your return above the rate of inflation.

If inflation is running high, your portfolio is going to need bigger gains just earn a real return. This is where speculation can help you.

What Is Value Investing With Speculative Characteristics?

I wholeheartedly agree with Benjamin Graham that buying an overvalued stock in the hope of selling it for a higher price is both risky and not actually a smart investment.

But if you accept that everyone is a speculator since all investors hope to sell in the future at a higher price, value investing becomes a tool to help increase your odds that you are at the bottom of Mr. Market’s range and that one day he will offer you a much better price and you will take it.

Even Graham acknowledges that there is a “speculative factor” in play in all investments. In the Intelligent Investor he notes:

“In most periods the investor must recognize the existence of a speculative factor in his common-stock holdings. It is his task to keep this component within minor limits, and to be prepared financially and psychologically for adverse results that may be of short or long duration.”

Value investing with speculative characteristics uses Graham’s value investing lens while at the same time acknowledging and in fact embracing the “speculative factor.”

Graham continues:

“There is intelligent speculation as there is intelligent investing. But there are many ways in which speculation may be unintelligent. Of these the foremost are:

(1) speculating when you think you are investing;

(2) speculating seriously instead of as a pastime, when you lack proper knowledge and skill for it; and

(3) risking more money in speculation than you can afford to lose.”

I think it is wise to have the majority of your stock holdings in classic safe Benjamin Graham value investments. (The older you are the more important this is, younger people can afford to take higher risk.)

But given the difficulties of value investing in this environment, I believe it is important to have a portion of your portfolio set aside for intelligent speculation.

Where I deviate from Graham is that I don’t think this should be a pastime. This is something you should take seriously, just as seriously as your traditional value investing, and you should seek to develop your knowledge and skills.

However you should keep position sizes small and use value strategies to minimise the speculative risks.

How To Be A Value Speculator

The key thing to being a value investor with speculative characteristics is to stick very closely to the traditional Benjamin Graham model.

You are still looking a mismatch between price and value. You want to buy something quality with a margin of safety, but something where the price can go bang when the market moves.

This requires a contrarian mindset and a willingness to go against the herd. You need to avoid F.O.M.O when investing and be disciplined enough not to chase overhyped and overvalued trends. It’s very much an art and not a science.

Commodity producers are great candidates. Large diversified miners or more specialised producers of things like gold or uranium are particularly good value speculations.

This is because the volatility of the stocks provides a lot of opportunity for speculation. The stocks follow the price of the underlying commodity which follows fairly predictable market cycles. If you understand that cycle and are patient, big rewards are available. In this game it is essentially a transfer of wealth from the impatient who cannot stomach volatility to the patient who can.

Moments of crisis, especially geopolitical crisis, are often times where there are amazing speculative value opportunities. In the fear and panic people sell everything and those with courage and foresight are able to pick up amazing bargains.

When you are able to pick up companies that pay quality dividends at bargain basement prices as you watch your dividend yield grow significantly when considered against your purchase price.

One of the most famous case of crisis investing was by John Templeton who borrowed money to buy stocks in 1939 when World War Two broke out. The geopolitical risk had caused a sell off in the stock market. As a man with a keen eye for value, he pounced on the opportunity.

I have five main criteria, (with a sixth as a bonus), that I look for when buying a value speculation.

- At least mid-cap but preferably large cap

- Trading near 50% below previous highs

- Have strong fundamentals

- Performs well in a Benjamin Graham value analysis

- Pays a dividend

- Bonus if it is a commodity producer

Let’s go through them one by one.

At least mid-cap but preferably large cap: The largest speculative gains are in small-caps. But these are also the riskiest. I want large cap assets because of their safety and the lower volatility. Small-caps also don’t normally pay dividends and I want dividends.

Trading near 50% below previous highs: Doug Casey says that any asset trading at 90% below an all time high is worth a look. I agree in general, but for large cap companies, I put the mark at 50%. It’s just not all that likely that they will drop down to 90% outside of a once in a generation crisis. The reason I want a 50% drop is I’m looking for at least 100% upside potential when the mean reversion happens.

I also want some historic price data to help me base my analysis on. So while it is possible to buy a stock at or near all time highs and ride it to new all time highs I don’t see much margin of safety in that. I like to buy well below all time highs knowing that I will get 100% if it just returns to that point and anything beyond is a nice bonus.

And if the dividend pay out is not reduced then a 50% drop means a doubling of the dividend yield when compared against the yield offered at the previous high.

Have strong fundamentals: This one should go without saying. Fundamental analysis is the cornerstone of any value investing strategy, so it has to be there.

Performs well in a Benjamin Graham value analysis: Note I said “performs well.” It doesn’t have to measure up perfectly. There are a number of valuation criteria you can use. I use several but it needs to meet the threshold of being undervalued primarily because of some short term catalyst which has caused the market to dump it. This way the prospect of a medium to long term recovery in price will be available for the patient investor.

Pays a dividend: Dividends form a key part of the value analysis as articulated by Benjamin Graham. But I like them better for the reasons Doug Casey outlines.

“Reported earnings can be fictional, and book values can be subject to accounting tricks. But dividends are actual cash in your pocket. They are real. So I’d have to say that if there were one really quick indicator of value, dividends are at the top of the list. It’s incredible what you can get in dividends alone when a market is at a bottom—something a lot of people have forgotten.”

Bonus if it’s a commodity producer: I love investing in commodity stocks. As previously mentioned the volatility of the stocks provides opportunity for speculation if you understand the cycle of the underlying commodity and are patient. If it’s not a commodity producer, at least the company should have significant hard asset exposure.

Read More: 5 Reasons To Consider Purchasing Hard Asset Stocks

Read More: How To Avoid F.O.M.O in Investing [11 Helpful Strategies]

Read More: How Value Investing Can Benefit From Technical Analysis

FAQs

What Is Value Investing?

Traditionally understood, value investing is buying an asset for below what you perceive its true worth to be. As the saying goes, “price is what you pay, value is what you get.”

What Is Speculative Investing?

Traditionally understood, speculative investing is buying a risky asset without any thorough analysis, hoping you will be able to sell it for a higher price in the future. This traditional understanding defines high risk unwise speculations. However, I think every investment is speculative. If you are smart you will do a thorough analysis and try and limit your downside risk.

What Is Value Speculation?

Value speculation is a recognition that all investments are speculative but that you can minimise your risk by using a traditional value investing approach to find undervalued assets.

Does Value Investing Work?

Yes, value investing works. However, returns will vary and are only as good as the trades made by individuals. While traditional value investing is not going to get you the returns you might see in high flying tech stocks, it is lower risk and does not rely on you correctly picking which tech is the next big thing.

Is Value Investing Dead?

Value investing is never dead. It might seem that way towards the latter end of a cycle where there is a lot of liquidity pushing markets higher. But buying attractive stocks at a good price will never go out of fashion.

How Do You Become A Value Investor?

Just get started. If you only have a small amount of money find a low fee brokerage, do your research and dive in.

How Much Of Your Portfolio Should Be Speculative?

Since I am of the view that all investing is speculation, I would say that 100% of your portfolio is speculative by its nature. It’s just a question of whether it is high or low risk speculation. But the question probably assumes the traditional definition of speculation. The answer to this is deeply personal but the general rule of thumb is that the older you are the less risk you should take on.

When Do You Sell If You Are A Value Investor?

This is the great question that value investing struggles to answer. It is great at identified undervalued assets but not so great at deciding when to sell. Sure, you could just sell when the asset reverts to the mean and is fairly valued again. But then you miss out on any further profit potential if the asset runs well into overvalued territory. What I do is use technical analysis as a secondary tool to help me time my exit strategy.

Conclusion

The unsound money economy we inhabit makes generating a return on your money more difficult.

Saving is next to useless as interest rates are so low and inflation eats away at the principal.

Investing too is also more difficult as markets become chaotic, valuing assets becomes difficult and higher returns are needed to protect against inflation.

My approach to investing in this market is to take Benjamin Graham’s method of value investing and fuse it with Doug Casey’s smart speculation and crisis investing.

This isn’t the dumb speculation where you buy an overpriced asset and hope to sell it even higher to a greater fool.

This is buying undervalued assets that have significant speculative potential, a healthy dividend yield and limited downside risk.

Graham himself recognised the possibility of intelligent speculation and I am fully embracing that with both arms.

Sources

Ammous, Saifedean. The Bitcoin Standard : The Decentralized Alternative to Central Banking Hoboken, New Jersey: John Wiley & Sons, Inc, 2018.

Graham, Benjamin, Warren E Buffett, and Jason Zweig. The Intelligent Investor : A Book of Practical Counsel. New York: Harper Collins, 2013.

Graham, Benjamin, and David L Dodd. Security Analysis : Principles and Technique. New York: Mcgraw-Hill, 2009.

Image Credits

Black and silver laptop by Yorgos Ntrahas on Unsplash

Benjamin Graham is licensed under CC-BY-SA 4.0

Margin of Safety is licensed under CC-BY-SA 4.0