Last Updated on January 21, 2025

There are times in history where the government reluctantly accepts that state money has failed and the market’s money has proven superior.

One such example was in the Ming Dynasty and silver.

The government had initially banned silver and decreed that the citizens should use devaluing paper currency. Unfortunately for the authorities, the citizens continued to use silver and refused to use the paper money. Eventually the government was forced to recognise this reality and accepted that their money had failed. The Ming Dynasty then went onto a silver standard.

The parallel to the present day is striking.

We live in a society with a rapidly devaluing fiat currency. There is also a rapidly rising alternative currency called Bitcoin.

We haven’t reached a tipping point yet where society at large rejects the fiat currency, but this is coming. Unless soundness and faith is restored to fiat currency, it is likely to be rejected sometime in the future.

The only questions are, when will it happen, how much of a fight will governments put up, and what money will the market turn to instead?

Like the Ming, we have silver. But we also have gold, Bitcoin and Monero. There is a strong case that Bitcoin’s superior qualities means it will emerge as the new currency, resulting in governments finally admitting their fiat currencies have failed.

To gain insight into how this might play out it is worth studying Ming China to see how the ‘government vs market’ money showdown happened in the past.

Ming Dynasty Paper Money

The Ming Dynasty ruled China from 1368 to 1644 and are often seen as a bridge between ancient and modern China.

When they took power, China already had a long history of silver as money but had also engaged in several failed attempts at paper money under the previous Song and Yuan dynasties.

At the start of their rule, the Ming continued with the policy of the Yuan, issuing paper currency and prohibiting the use of silver.

The paper currency, the baochao, had a defined weight in silver but it was not legally able to be converted into the metal.

Regardless of the silver prohibition the citizens continued to use silver and bronze coins in defiance of the emperor. The public had no faith in the paper currency because of its devaluation.

Thankfully for the people the silver ban was not strictly enforced.

An imperial official at the time explained the problem:

“For years the paper currency law has been unenforceable, the reason being that the imperial court issued too much currency and had no way to reclaim it, so that goods were valued more highly than currency.”

After centuries of money printing the citizens had learned not to trust government currency and put their faith in hard money instead.

Ming Dynasty Silver

Unlike the Song and the Yuan, who debased themselves into oblivion, the Ming eventually learned their lesson. They accepted the market reality and failure of their currency by allowing the remonetisation of silver.

In The Empire of Silver Jin Xu explains that this was because government officials were unhappy that their salaries were being paid in rapidly devaluing currency.

“In terms of official salaries, Ming dynasty officials, who ranked among the interest class, were at first paid in paper currency, but salaries shrank due to inflation. Contemporary historical records verify that official salaries were greatly discounted by inflation, because the purchasing power of the currency with which they were paid suffered catastrophic decline… As it became impossible for officials to make a living, policies naturally had to be amended.”

Of course the government class can impose suffering on ordinary people, but when it suddenly affects them, only then do they do something about it. Some things never change.

While the ban on silver could have been stubbornly maintained, it wasn’t enforceable over the long term. Jin Xu explains again:

“When paper currency became devalued, the Ming dynasty government had to wield its administrative power to force everyone to use it. But this administrative force could never be sustained for long, because the bureaucratic clique that represented it was the first to resist this kind of action. With the welfare of officials also affected by devaluation, continued expansion of the paper currency system naturally became difficult. Whether due to active resistance or passive execution, the administrative measures would be difficult to enforce. Ultimately, the emperor would discover that he was fighting his battle alone, and that the bans existed on paper only.”

To keep the bureaucrats happy, as the paper money was debased, the solution was to pay salaries in a combination of silver coin and paper.

By 1508, 140 years after the start of the Ming Dynasty, the paper had been debased to such a point that bureaucrats salaries were paid entirely in silver.

In 1567 the law finally met the market reality. The silver ban was overturned and silver was fully monetised.

How The Ming Dynasty Might Shed Light On Bitcoin’s Future

Governments now, as they did in ancient and medieval times, have the sovereign right to impose their monetary system on the nation.

They can do whatever they want.

However, that does not mean that government policy will be either successful or enforceable.

Governments always govern with the consent of the people. Even monarchies and dictatorships have limits and if they impose unworkable ideologies they will eventually fail.

If a government imposes unsound money either they will have to reverse that policy, which the Ming Dynasty did, or if they persevere, the regime will eventually fall, as the Song and Yuan did.

Society has the power to reject the government’s unsound money and operate a parallel hard money system alongside.

Governments will always act in their own interests and monetary policy is no different. Initially they issue paper money because it is their interest to do so. The ability to devalue the currency by creating new units allows them to increase their expenditure.

But eventually a tipping point is reached where issuing paper money stops being in the government’s interest. When the economy declines, tax revenue stops flowing and government officials don’t want to be paid in paper. There is little incentive for the government to continue with the failed monetary system.

If they have any sense they will make a change. Otherwise, they will destroy their state from within and be ripe for domestic regime change or defeat by an external invader.

As Jin Xu notes:

“From the perspective of the economics of government, when paper currency becomes increasingly unpopular, the excessive issue of paper currency also becomes increasingly unprofitable. When the profit becomes lower than the cost, the government has no motivation to continue it.”

History records plenty of examples where hubris prevented any change in monetary direction. Unsound money persisted and the regime eventually fell. The Ming example shows that it is possible for governments to quietly admit their error and accept the market reality.

So what will our modern monetary authorities do?

Will they pursue the failed system and print into oblivion or will they make a change?

As Jim Rickards often says, our monetary authorities are not stupid. In fact, they are incredibly smart. They are just using the wrong models. So if they eventually realise they are going down the wrong path there is a decent chance that they will change course. And hopefully seek to restore soundness to the Dollar and the many fiat currencies that are connected to the Dollar.

The obvious way for governments to do that would be to remonetise gold. This is something that Rickards suggests is possible and even likely.

However, just as silver still circulated during the Ming Dynasty as a parallel monetary system, we have Bitcoin emerging as an alternative parallel monetary system.

There may come a time where fiat currencies are legal tender but people refuse to accept payment in them and demand payment in Bitcoin instead. We have already started to see this in the USA with some elected officials being paid in Bitcoin.

There may be a scenario, where in an act of humility, governments quietly admit that their fiat currencies have failed. Like the Ming, governments could accept the market reality on the ground with Bitcoin becoming the monetary standard because of massive market adoption.

Personally, I can see this happening but I don’t see it happening quickly or easily. I think the government will try and hold on as long as they can. Even in Ming China this development took place over hundreds of years as the government persisted with their paper currency, paying salaries in a combination of both silver and paper.

I think the more likely scenario is a slow decline in the acceptance of fiat currency amongst the public, while governments and central banks try a range of solutions to try to maintain confidence.

For example, they might remonetise gold and back their paper with a hard asset. This brings a greater soundness to the currency while ensuring they remain in control. They also might make use of the IMF’s SDRs.

If a fiat currency were to fail, they might even try to issue a new one, with a greater degree of hard asset backing. This is what happened in Weimar Germany.

If all of that fails, then perhaps governments will be ready to follow the path of the Ming. Acknowledge the market reality and accept Bitcoin as the monetary standard.

I think if governments were smart they would get ahead of this curve and adopt hard money now. The Ming would have saved themselves a lot of pain if they adopted a silver standard from the start.

But I don’t think this is how it is going to go. The US especially, has enjoyed such a huge privilege from having the reserve currency and being able to print as much as it wants, that it is not going to want to give that up very easily.

But ultimately sound money will prevail, as it has throughout history.

Conclusion

Jin Xu summarises the problem for the Ming beautifully:

“Paper currency died out and silver revived according to the usual hypnotic and painfully swinging pendulum of history. The lure and danger of paper currency are that it can seemingly be issued at will but is ultimately doomed to self-combust. Generations of rulers have always forgotten this point.”

While this quote is talking about a 500 year old dynasty it is equally applicable to our society today.

Fiat currencies around the world are rapidly devaluing. Society at large is still using these currencies but are suffering the consequences.

Unlike the Ming citizenry, who had a deep aversion to paper money, most people are happy enough at the moment to hold their wealth in fiat currency. We don’t have the same cultural distrust in government money.

But as more and more people recognise the monetary debasement, they will reject the currency. Individuals will then turn to alternatives such as gold, silver, Bitcoin and Monero.

The response of governments remains to be seen. They might print themselves into oblivion, they might remonetise gold and try to restore confidence in government paper, or they might accept defeat and accept free market money.

The lesson of the Ming is that the latter is possible. But you must be patient.

Sources

Rickards, James. The New Case for Gold. London: Penguin Business, 2019.

Xu, Jin. Empire of Silver: A New Monetary History of China. New Haven: Yale University Press, 2021.

Image Credits

Hall of Supreme Harmony by Rafik Wahba on Unsplash

Administrative Divisions of Ming Dynasty is licensed under CC-BY-SA 4.0

Baochao is in the public domain

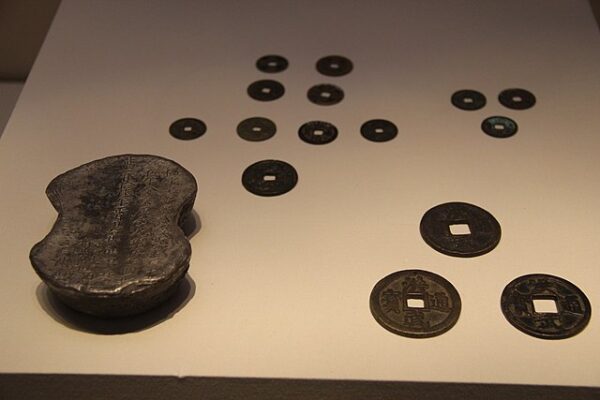

Ming Coins and Silver Ingot is in the public domain