Disclaimer

This article is for informational and educational purposes only and does not constitute financial advice. The author may hold positions in the assets discussed. Any discussion on jurisdiction, exchanges or custody providers reflect the author's personal views and experiences and is not a personal recommendation. Always do your own research and seek professional guidance before making investment or custody decisions.

Last Updated on April 22, 2025

Key Takeaways

- The history of fiat currency failures shows that every fiat issuer has misused the privilege by overprinting, leading to inflation or hyperinflation.

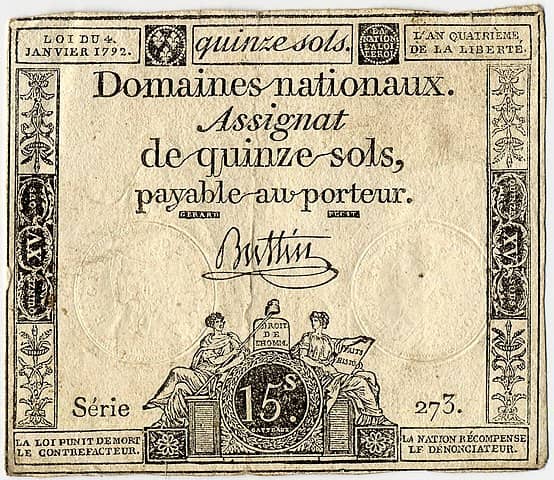

- Estimates for the number of failed fiat currencies range from the hundreds to the thousands, depending on how you define “failure.” Some famous historical collapses include China’s Jiaozi, France’s Assignat, Weimar Germany’s Mark, the Zimbabwean Dollar, and the Venezuelan Bolivar.

- Citizens lose trust in fiat currency when it loses value rapidly and fails to act as a store of value, turning to gold, silver, or stable alternatives.

- Hyperinflation destroys societies, causing political unrest and economic collapse.

- To protect yourself, don’t store you wealth in fiat currency. Instead store it in hard assets such as gold, silver, land or Bitcoin.

The history of fiat currency failures reveals a very predictable pattern.

The government starts with a small issue of paper money, thinking that they will just use it the once. Then they use it a second time. Then another and another, and another.

Soon they are addicted.

The government eventually prints too much, creates inflation or hyperinflation, destroys the economy and the currency is rejected.

Every fiat currency in history that is not currently in circulation has failed.

How many fiat currencies have failed you ask?

It’s hard to say for sure because it depends on your definition of failure and whether they hyperinflated into destruction or were merely replaced or redenominated. However estimates of the number of failed currencies range from the hundreds to the thousands.

We are currently living in an era of high inflation, in other words rapid fiat currency destruction. Therefore it would be wise of us to look to the past to see how fiat currency failure unfolds and what we can do to protect ourselves.

Why Does Fiat Currency Fail?

Every failed currency falls because eventually it ceases to function as a store of value and therefore as a medium of exchange.

When that occurs people do two things:

- They refuse to hold the currency

- They sell it as soon as they get any, either for goods or for a form of money that can hold its value.

Traditionally that was gold and silver, now it includes Bitcoin.

To properly understand the history of fiat currency failure and why fiat is always doomed, you first must understand why it is such an attractive thing for a government.

Governments because they can use it to transfer wealth from the future to the present and therefore they can spend beyond their means.

Taxation and borrowing have limitations, but creating new units of currency is a much easier method of government financing.

Once they start, they cannot stop. They must print.

Unfortunately for governments there is one thing and one thing only that limits their ability to use fiat currency.

That is the willingness of the citizens to adopt and use the money.

Sometimes the people can be coerced into it over the short term. But in the long term, if the government mismanages and debases the currency then the citizens will reject it and turn to hard money alternatives.

When they happens en masse, the currency is doomed.

History shows that it always happens, it is just a matter of time.

The lesson to be learned from the history of fiat currency failure is this:

Never use it to store your wealth.

Sure, use it as a day to day transacting currency. That is what it is good for after all. But you are always at risk of gradual devaluation and sometimes at risk of catastrophic failure.

Therefore, instead store your wealth in hard assets that can’t be debased.

You could study any fiat currency failure and you will learn the same lesson. But to illustrate the point let’s explore a brief history of nine famous fiat currency failures.

| Bonus: Click here to find out how people throughout history protected themselves from fiat currency failure. |

9 Examples of Failed Fiat Currencies From History

1. Imperial Chinese Paper Money

The Chinese were the first to invent paper money. This took different forms across different imperial dynasties.

The first widespread paper money was the jiaozi that circulated in modern day Sichuan during the Song Dynasty.

This paper was initially a receipt for the deposit of iron money which was exchanged amongst the population as money. The governor allowed 16 families to manage this currency privately, although the government later decided to take over the currency management themselves.

It did not take long before supply started to increase and inflation was triggered. Soon they had to discontinue the jiaozi and replace it with a new currency, the qianyin.

After the Jin Dynasty was established in Northern China, the Song reorganised as the Southern Song Empire. In 1161 a new currency, the huizi was established across the empire. This became the first national paper currency.

The government understood the risks of paper money and placed strict controls on the money supply.

These controls did not last long and the temptation to print became too strong.

The huizi was printed in huge quantities, triggering the first nationwide paper money inflation.

The Yuan Dynasty that followed had their own paper currency, the jiaochao. Initially this was backed by silk or silver and was convertible. But it did not take long for the Yuan to print far more money than they had commodities backing it.

The currency was rejected and citizens had to resort to barter.

The Ming Dynasty also used fiat currency. Their version was called the baochao.

The government stipulated that this was the only currency to be used, however this decree was not widely enforced.

Chinese citizens had long since figured out not to trust government paper and preferred to use silver instead.

The more the baochao was inflated, the less the citizens wanted to use it. Eventually even government officials refused to have their salaries paid in it. The government finally recognised this reality and gave up on trying to force the baochao on the population.

Silver was restored to full monetary status.

2. John Law’s Paper Money Disaster in France

John Law was a Scotsman who introduced the first paper money to France in 1716.

He had befriended the Duke of Orleans, who was the regent for the child king Louis XV, and convinced him that paper money was the way to get the French government out of debt.

Initially, this new paper money was limited in supply and was convertible to gold and silver.

Two years later the supply limitation was removed.

The Bank that had been set up to manage the currency printed more and more notes.

Around the same time, Law had established the Mississippi Company and had acquired a monopoly on France’s foreign trade.

In what became the famous Mississippi bubble, huge demand for the shares in the Mississippi Company drove the share price from 500 livres to 18,000 livres.

During the speculative mania the government continued to print more and more paper money.

Eventually the smart money started taking profits, which triggered a collapse in the stock price of the Mississippi Company.

Recognising the danger of fiat currency, many converted their paper profits into gold and silver.

This was a wise move as inflation had reached 23%.

But it would soon destroy the monetary system.

Law initially responded by suspending convertibility into gold and silver and devaluing the paper currency by 50%. But this could not save the system.

The collapse of both the stock price of the Mississippi Company and the paper currency created chaos in France.

Law fled the country and the government returned to a monetary system based on gold and silver.

3. The Assignat of the French Revolution

It did not take the French long to make the same mistake again.

At the start of the French Revolution the National Assembly decided that the way out of the fiscal hole they were in was fiat currency.

The nation still bore the scars of the John Law experiments but this time they thought it would be different. This time they thought they would be able to control the fiat currency more effectively.

They were wrong.

The temptation to issue ever increasing amounts of fiat currency was too great for the revolutionaries to resist.

Within five years of the first issue, the new paper currency, the assignat, had lost 99% of its value.

Prices skyrocketed as the country descended into political, social and economic chaos.

It took Napoleon to restore financial order. He reorganised the monetary system based on gold and silver with the silver/gold ratio set at 15:1.

4. Hyperinflation in the Early Soviet Union

Tsar Nicholas II had placed Russia on the gold standard in 1897. This placed Russia alongside the other major powers in the world as part of the monetary system known as the classical gold standard.

When war broke out in 1914 Russia abandoned the gold standard, along with the other belligerent powers. This was so they could finance the war through the printing press.

Russia suffered heavily in the war with huge numbers of casualties, shortages of goods and skyrocketing inflation.

When the Communists took over in 1917 the nation was in disarray. They withdrew from World War One but the country then descended into a long civil war between Communist and anti-Communist forces.

Despite the incredible hardship caused by both wars Lenin, the Communist leader, still pursued his fanciful and destructive economic ideas.

This included financing his communist ideology through printing money, with the eventual aim of abolishing money altogether (crazy stuff!)

Lenin thought money was a capitalist anachronism.

Eventually reality caught up to the Soviet Communists and they were forced to rethink their policies.

As part of their New Economic Policy they backed the Soviet currency with gold. Money printing to cover budget deficits was forbidden.

5. Hyperinflation in Weimar Germany

The hyperinflation of Weimar Germany is perhaps the most famous fiat currency failure in history.

Germany too abandoned the gold standard at the start of World War One and printed money to pay for the costs of war.

The inflation actually started during the war as shortages and money printing drove prices higher.

Germany’s loss at the hands of the allies and the subsequent reparations payments made things worse.

By 1922 prices were doubling every month and strikes occurred as workers demanded higher wages.

Wages rose but the cost of living rose much faster.

In January 1923 the German government fell behind on their wartime reparations payments, so France and Belgium invaded.

The German printing presses went into overdrive to cover the lost production and pay striking workers.

Prices continued to rise in an obscene manner and the nation was thrown into total chaos. Farmers refused to accept paper currency in exchange for their products and so there were food shortages in the cities.

The hyperinflation was solved by introducing a new temporary currency called the rentenmark. This currency was backed by mortgages on land and bonds on German industry.

This was an inconvertible currency that too was fiat. But its theoretical backing with hard assets gave the public enough confidence in the currency to make it work.

With the stability provided by the rentenmark, the allies were prepared to deal with Germany to find a long term solution.

The 1924 Dawes Plan gave Germany a loan of $200 million dollars. This was to pay reparations for a year, recapitalise the Reichsbank and to build up the nation’s gold reserve.

This gave Germany the reserves it needed to then issue a long term currency, the Reichsmark, with a 40% gold cover in October 1924.

6. Hyperinflation in The Republic of China

The Republic of China adopted a formal silver standard in 1933 after many years of preparation.

They had intended to move to a gold standard eventually.

Unfortunately for China, they got their timing really wrong. In 1934 the USA passed the Silver Purchase Act, which compelled the US government to buy silver to support domestic production.

This sent silver prices higher, which caused deflation in China. Additionally, silver prices became higher in the USA than they were in China, which resulted in an outflow of the metal and a shortage of currency.

Prior to the Silver Purchase Act, China actually had the highest international price for silver, which had caused significant silver inflows.

The government decided to take over the banking sector and introduce a paper currency.

While they had originally planned on moving from a silver standard to a gold standard they decided they was now little point, after the USA became the final country to abandon gold in 1933.

The Republic of China decided to go straight from silver to paper.

In 1935 they introduced the fabi, an inconvertible fiat currency and ordered all citizens to hand in their silver. The government used the silver to buy U.S. dollars to act as reserves for the fabi.

When Japan invaded China in 1937, the government inflated the currency to finance the war effort.

Between the start of the war in 1937 and the end of the war in 1945 the money supply increased over 400x.

Prices soared.

When the Chinese Civil War restarted after the defeat of the Japanese, the Nationalist government continued to inflate the currency.

The fabi was replaced in 1948 by the gold yuan but that too failed.

In 1949 the Nationalist government retreated to Taiwan and the Communists established the People’s Republic of China. The CCP’s currency, the Renminbi, then became the currency of the nation.

The inflation of the fabi played a significant role in the Nationalists losing the Chinese Civil War as it eroded their support amongst the middle class who saw their wealth disappear before their eyes.

7. Hyperinflation in Post Soviet Russia

In 1985, when the last Soviet leader Mikhail Gorbachev embarked on his series of economic reforms, the inflation rate of the Soviet Union was 4.6%.

The Soviet economy was very unhealthy and Gorbachev recognised that if things did not change, the nation’s economy would decline significantly.

Gorbachev thought his economic reforms would preserve the socialist system and make it more efficient.

Instead it exposed the weaknesses of the Soviet economy and the system as a whole. As Gorbachev opened up the economy and the political system, things spiralled out of his control.

By 1990 inflation reached 19%. By the end of 1991 it was 200%.

Gorbachev’s political and economic reforms resulted in the disintegration of the Soviet Union as a political entity in 1991.

Russia, the successor state, continued to battle with inflation as it attempted to restore political and economic order.

However the Russian government was unsuccessful and the inflation rate reached 2,318% by the end of 1992.

It is estimated that more money had been printed in 1991 than the previous 30 years.

The high inflation of the Russia Rouble continued until 1995 when the government brought inflation under control by pegging the currency to the U.S. Dollar.

8. Hyperinflation in Zimbabwe

In the late 1990s, the Mugabe government in Zimbabwe enacted a series of land reforms which evicted white farmers in favour of black farmers.

Without the same level of experience, the new farmers were less productive than those who previously worked the land.

Food production fell and prices rose.

White Zimbabweans left the country and took their capital with them.

Economic sanctions were applied to Zimbabwe by the USA, the EU and the IMF. This led to the banking sector collapsing.

Around the same time, Zimbabwe was fighting a war in the Democratic Republic of the Congo. They were financing this conflict by printing money.

With the economy in disarray and unemployment rising, printing money became an attractive option to finance all the governments needs.

The combination of fewer goods and more units of currency in supply led to an explosive hyperinflation which peaked in 2008 at 79,600,000,000%.

Citizens got around this by using foreign currency, particularly U.S. dollars as a means of exchange.

This had been illegal but eventually the government relented and accepted reality, allowing the use of foreign currency in 2009.

The U.S. Dollar has been the dominant currency in Zimbabwe ever since.

9. Hyperinflation in Venezuela

Venezuela’s economy and therefore their currency is highly dependent on oil.

When demand for oil is high there is a corresponding demand for Venezuelan Bolivars to buy their oil. When demand for oil is low the demand for Bolivars falls away.

In 2014 there was a significant drop in the oil price and demand for Bolivars fell away sharply.

As the value of the Bolivar declined, the cost of imported goods rose.

New President Nicholas Maduro decided that his solution to the problem was to print more money.

This made the situation worse as international investors were reluctant to commit their money to the country and Venezuelans started selling their local currency for foreign currencies to protect themselves.

Maduro then implemented currency controls which created a thriving black market of U.S. dollars.

From an inflation rate of 69% in 2014, Venezuela reached an inflation rate of 1,700,000% in 2018.

Enormous numbers of Venezuelans fled the country during the crisis.

In 2019 Maduro relaxed some economic controls, allowing the U.S. dollar to circulate alongside the Bolivar.

In December 2021 Venezuela exited hyperinflation according to the textbook definition of a lower than 50% monthly inflation rate for 12 months.

However, the Bolivar is still experiencing extremely high inflation. In October 2022 the annual inflation rate was 155.8%.

The Implications of Fiat Currency Failure: How Can You Protect Yourself?

Some fiat currency failures are spectacular crashes. These are the ones that tend to make the history books.

Others are slow drawn out affairs where the currency is steadily devalued over time until it is no longer fit for purpose.

Weimar Germany was an example of the former, our current system is an example of the latter.

Is our global fiat currency system based on the USD any different from the catastrophic examples above?

In its nature, it is no different. The only difference is that our system is managed well enough that the failure is happening slowly.

For now the system is resilient enough to continue but it is steadily failing before our eyes as purchasing power is eroded via inflation.

The question for us living through it is what to do about it?

Luckily there is a simple answer that can be found in history. Many people in different times and different places around the world have experienced this phenomenon, so we just have to follow their example.

The answer is to hold real assets. Assets that will hold their value regardless of the fiat currency system of the day.

Dynastic money has always understood this phenomenon and protected their wealth by storing it in real estate, gold and fine art.

Regimes and currencies can come and go but those assets have always retained their value and retained their purchasing power.

Bitcoin is another asset that fulfils this function exceptionally well. Bitcoin’s fiat price rises faster than the rate of inflation, which in other words means it gains in value even as the fiat currency its price is quoted in declines in value.

Gradually more and more people will recognise the folly of storing wealth in fiat currency and will choose Bitcoin as a superior store of value.

Frequently Asked Questions

It’s not possible to give an exact figure here due to varying definitions of what “failure” means. Some have failed due to hyperinflation, others have been discontinued and replaced. Estimates range from the hundreds to the thousands. They key thing is that every fiat currency eventually fails.

Fiat currencies typically fail due to one or more of the following factors: hyperinflation, excessive government debt, economic mismanagement, political instability, or loss of confidence in the issuing authority. Eventually the population understands that is better not to hold fiat currency and hold real assets instead. When this becomes a stampede for the exits, the currency fails.

All fiat currencies eventually devalue or collapse, but some have survived for now through redenominations, reforms, and central bank interventions. Nothing lasts forever. Just as empires rise and fall, so too do currencies.

If history repeats itself then yes, this current system with the current variation of the USD at the centre will fail. That doesn’t mean it is imminent, as some people suggest, this could play out over decades and could take many different forms.

Approximately 25 – 35 years. Some will last much shorter than that and others manage to continue for much longer. The longest lasting fiat currency still in circulation is the British Pound.

One of the most recent examples is the hyperinflation in the Venezuelan Bolivar, which reached an inflation rate of 1,700,000% in 2018. Another example is Lebanon, who devalued their currency by 90% in 2023.

You have to hold real assets that hold their value regardless of the fiat currency whose price they are quoted in. Traditionally this has meant gold, real estate and fine art. Now we have Bitcoin as superior option.

Conclusion

The success of fiat currency relies on the ability of the monetary authority to maintain the soundness of the currency over a long period.

Some governments and monetary authorities can keep a fiat currency alive for quite a long time, especially if it has some degree of gold backing. Others are far more short-lived.

However, the temptation of money printing that fiat currency allows is extremely seductive. Even those who understand the need for restraint eventually give in.

Fiat currencies come and go. What always remains is hard money such as gold and silver.

The U.S. Dollar began its life as a fixed weight of silver, then it became a fixed weight of gold. Now it is a purely fiat currency without being bound to hard money.

That it has been used to stabilise hyper inflationary conditions in Zimbabwe and Venezuela only serves to illustrate that as the global reserve currency it is the most stable fiat currency in the world.

Nevertheless as a fiat currency, it too cannot last forever. It will fail as every fiat currency in history has failed.

We should prepare for that fact now, while times are still good, and make sure we are protected with some hard money when it is inevitably needed.

To your protection and prosperity,

Thomas

P.S. Have I left out anything important? Please let me know. Or if you found this information to be of high value, drop me a line, too. I love hearing from readers.

Sources

Fergusson, Adam. When Money Dies: The Nightmare of the Weimar Collapse. London: W. Kimber, 1975.

Quddus, Munir, Jin-Tan Liu, and John S. Butler. “Money, Prices, and Causality: The Chinese Hyperinflation, 1946–1949, Reexamined.” Journal of Macroeconomics 11, no. 3 (June 1989): 447–53. https://doi.org/10.1016/0164-0704(89)90070-0.

White, Andrew Dickson. Fiat Money Inflation in France: How It Came, What Brought It and How It Ended. New York: Appleton-Century, 1933.

Image Credits

Zimbabwean Dollars is in the public domain

Jiaozi is in the public domain

Assignat is in the public domain

Papiermark is in the public domain

Fabi is in the public domain