Last Updated on January 27, 2025

Hard asset stocks are a convenient way to get exposure to the underlying asset and can be either defensive or a great speculation.

What you are looking for are equities that own a lot of tangible assets and whose valuation is primarily composed of that hard asset exposure.

This is significantly different from something like tech stocks, which often have little in the way of hard assets.

Investing in hard assets stocks is often much easier than trying to purchase the asset itself.

What Are Hard Assets?

Hard assets are tangible and physical resources you can touch and feel that are used in the real economy.

Examples of hard assets are things like real estate, farmland, gold and silver, infrastructure, energy and transportation.

Stocks on the other hand are paper assets or soft assets. Buying stocks does not allow you to hold tangible wealth in your hands.

They are tradable financial instruments that merely represent a claim of ownership; they don’t have any other functionality.

So if you want genuine hard asset protection, you should buy hard assets.

For example, it is normally recommended to build a position in physical gold before you start considering purchasing shares in gold mining stocks.

However, if you are happy with how you are positioned in hard assets you might consider investing in stocks with hard asset exposure.

Even though you are buying a paper claim, you are in effect purchasing ownership of a hard asset.

This way you get the benefit of owning hard assets through the convenience of a financial instrument without the hassles of ownership, storage, insurance and lack of liquidity that might come with buying the hard asset itself.

Why You Might Consider Investing In Hard Asset Stocks

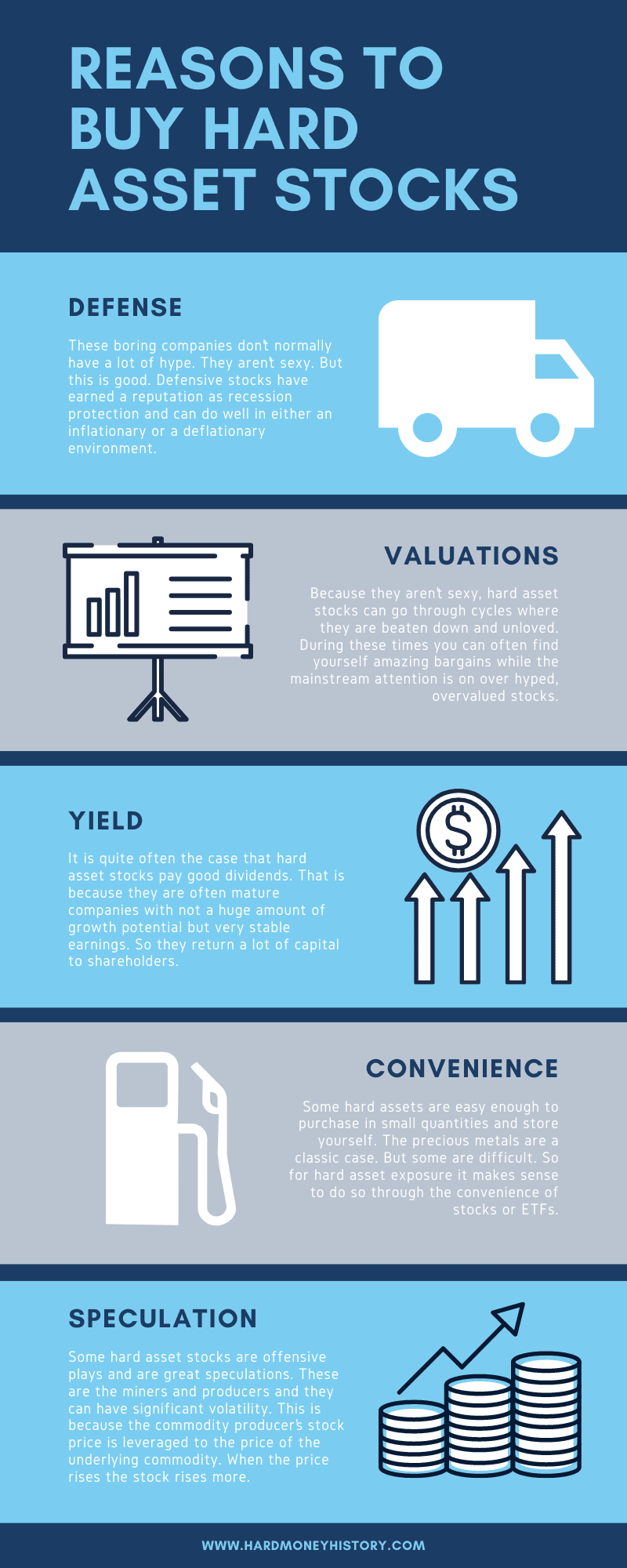

1. Hard Asset Stocks Are a Defensive Play

A defensive investment is one in a sector that normally stays reasonably stable regardless of what is going on in the broader economy or the stock market.

Think consumer staples, healthcare and utilities. These are things that people need regardless of whether it is good times or bad.

Hard assets fall into this category as well. Some sectors are more volatile than others e.g. oil, uranium and silver, but the tangible nature of hard assets means they will always retain some value and will often perform quite well in a market correction or crash.

Jim Rickards gives the example of Warren Buffett buying up railroads:

“What is a railroad? A railroad is nothing but hard assets. It’s right of way, mining rights adjacent to the right of way, rail, rolling stock, yards, switches, signals, buildings, it’s all hard assets. How does the railroad make money? It makes money by moving hard assets so coal, wheat, corn, steel, other kinds of freight, etc. So, railroad is the ultimate, its hard assets moving hard assets. It’s the ultimate hard asset play.”

However, you don’t just have to buy railroads. Sectors such as transportation, energy, mining, utilities, agriculture, manufacturing are full of companies whose wealth is primarily held in hard assets.

These boring companies don’t normally have a lot of hype. They aren’t sexy. But this is good.

Often fashionable sectors such as technology have companies that trade at very high P/E ratios will very little in underlying hard assets. With these companies, you are investing in ideas and in hopes of future earnings.

With the boring transport company you are investing in something tangible like trucks or ships or railroads, often at more reasonable valuations.

These defensive assets that are likely to perform well regardless of what happens to the dollar.

As Rickards says of Buffett:

“So, Warren Buffett’s a guy who’s dumping paper money, getting into hard assets in the form of transportation and energy in particular. And the dollar could go to zero and it has no effect on him. He still owns a railroad.”

Although, Peter Schiff notes that if the dollar did go to zero, that would generate a collapse in the economy, which would be very bearish for stocks. Nevertheless they would lose less value than the dollar as they would still have value when priced in gold or foreign currencies.

“The fact is that stocks, unlike cash and bonds, which have intrinsic value, represent ownership of assets—real stuff—and therefore have some value, assuming the issuing company remains viable and there is some kind of market in which the assets can be exchanged for value. Of course, that value will change for better or worse as the economic crisis plays out.”

Regardless of the economic turmoil Buffett would still have his railroad, although it may be worth far less than it was before.

Peter Schiff also argues that defensive stocks have earned a reputation as recession protection and can do well in either an inflationary or a deflationary environment. He notes that stocks have historically risen with inflation rates, although he argues that in an environment of extreme inflation such as the 1970s that gold performs far better as an inflation hedge.

2. Hard Asset Stocks Are Often Attractively Valued

Value investors like Benjamin Graham and Sir John Templeton teach that you should think like an owner when you buy stocks.

This means you shouldn’t buy a stock merely to speculate that it’s price may one day rise, although of course you will aim to sell higher in the future.

Rather you should buy a stock with the mindset that you are buying the underlying business. You are buying the assets that the company holds – all the plant, machinery and equipment – as well as the management team.

In thinking of yourself buying the assets in this way, it makes sense to think about purchasing companies that own a lot of hard assets.

Because they aren’t sexy, they can go through cycles where they are beaten down and unloved.

During these times you can often find yourself amazing bargains while the mainstream attention is on the over hyped, overvalued pretty stocks that may not have much in tangible assets.

When the reversion to the mean takes place the hype stocks will fall, while the hard asset stocks will rise as more and more investors look to defensive plays. If you were in the defensive play early and at a good price then you stand to gain.

3. Hard Asset Stocks Often Have An Attractive Yield

It is quite often the case that hard asset stocks pay good dividends.

That is because they are often mature companies with not a huge amount of growth potential but very stable earnings. So they return a lot of capital to shareholders.

This lack of growth potential is what puts off a lot of short term investors. But if you buy them for the long haul during a short term downturn at an attractive valuation then it is still possible to get some capital growth and pick up a healthy dividend on the cheap.

High yields are often found in REITs, basic materials, consumer staples, telecommunications and utilities.

This is especially the case in high dividend markets like Australia and New Zealand.

4. Hard Asset Stocks Are Convenient

Some hard assets are easy enough to purchase in small quantities and store yourself.

The precious metals are a classic case.

Real estate is relatively easy to purchase but there is a very high barrier to entry and it is not fungible.

But no retail investor is realistically going to be able to purchase things like uranium, oil, natural gas, ships, trucks or railroads.

So for exposure the way to invest in these hard assets is through stocks or ETFs.

If you are willing and able to do your research on specific companies then buying individual stocks makes sense. But if you can’t or don’t want to do that, then you can find an ETF for almost any sector you can think of.

You can also buy an ETF that gives you broad exposure to hard assets in general rather than focusing on one specific sector such as the Van Eck Natural Resources ETF.

Some examples of popular hard asset ETFs include:

- Energy Select Sector SPDR Fund (XLE)

- VanEck Gold Miners ETF (GDX)

- Industrial Select Sector SPDR Fund (XLI)

- Utilities Select Sector SPDR Fund (XLU)

5. Hard Asset Stocks Can Offer Great Speculations

Most investors look to hard assets as a defensive play, as has already been explained. Some hard asset stocks, such as utilities, are remarkable in that they lack volatility and offer great safety.

However there are some hard asset stocks that are offensive plays and are great speculations. These are the miners and producers and they can have significant volatility. This is because the commodity producer’s stock price is leveraged to the price of the underlying commodity.

When the price rises the stock rises more. When the price falls the stocks falls further.

This happens because the company’s profitability is based on both the commodity price and the cost of production. Even a small rise in the price of the underlying commodity can cause a dramatic increase in profitability if the cost of production remains steady.

Miners and producers in cyclical markets such as oil and gas, uranium, gold, silver and copper can be some of the most explosive stocks on the planet.

They can also offer amazing dividend yields when you buy at the bottom and watch the dividend grow over time.

Read More: How To Invest In Copper

Conclusion

If you understand hard money then you understand the importance of value.

Similar principles apply to investing in the stock markets. While you can make good returns on companies that trade on high earnings multiples with little in the way of hard assets, there are risks involved.

Hard asset stocks can offer attractively valued defensive investments with good yields.

As a conservative investor I like to hold a lot of defensive hard asset stocks for the safety and the yield, while allocating a small amount of my portfolio into the speculative miners.

Sources

Schiff, Peter D. The Little Book of Bull Moves : How to Keep Your Portfolio up When the Market Is Up, Down, or Sideways. Hoboken, N.J.: Wiley, 2010.

Image Credits

Nuclear Power Plant by Lukas Lehotsky on Unsplash

Railroad by Ankush Minda on Unsplash