Last Updated on January 24, 2025

The classical gold standard was the monetary system of the 1870s to 1914.

The world’s industrial powers defined their national currencies as a fixed weight of gold and paper money was freely convertible into gold by government and private citizens alike.

It was a golden age in many ways as the world experienced a sustained period of economic freedom and flourishing, with little of the social costs we experience today as a result of fiat currency.

As Michael D. Bordo explains:

“The period from 1880 to 1914, known as the heyday of the gold standard, was a remarkable period in world economic history. It was characterized by rapid economic growth, the free flow of labor and capital across political borders, virtually free trade and, in general, world peace.”

Gold as the common money of the world allowed for easier international commerce. There was no need for business to worry about the impact of floating exchange rates.

Sound money meant high savings rates. This led to the accumulation of capital which was then able to finance industrial expansion.

The classical gold standard provided long term price stability as governments had only limited discretion to inflate the supply of money or use monetary policy to further their own ends.

Paper notes were issued which gave flexibility and removed the need for cumbersome gold to be moved for every transaction. But everyone knew that gold was the real money and the paper notes were merely reflections of the real thing.

Sadly the outbreak of the World War One in 1914 brought an end to the classical gold standard.

Gold was a handbrake on state finances and ending the gold standard enabled them to use the printing press to fund the war through inflation rather than taxation and borrowing.

One of the real tragedies of the classical gold standard is how poorly understood it is.

Its reputation has been besmirched by a century of propaganda suggesting it was a historical relic that didn’t work and wouldn’t work again.

Its critics deny its effectiveness in order to justify the fiat money system we have today.

But the classical gold standard did work and it worked well. It was not without its flaws but that doesn’t mean that economists should snigger at it or those who advocate its merits.

In fact the biggest flaw of the classical gold standard was that the gold and thus the entire monetary system was centralised under government control. Because it was a government managed system they could just abandon it when it was no longer convenient to them.

This flaw does not make the fiat system superior, since central banks have even more control.

Rather this flaw suggests that a more effective system would be a more decentralised one with less or even no government control.

Even though the classical gold standard was a quite effective system while it lasted it was at the mercy of those in power and when it didn’t suit their agenda anymore it was ended.

When fiat money fails society will need an alternative. If we want sound money again in the future it would be wise for us to understand how the classical gold standard worked.

As President Herbert Hoover once said:

“We have gold because we cannot trust governments.”

How the Classical Gold Standard Emerged

Gold has been used as money for thousands of years. Its superior monetary qualities were recognised in the ancient world and it has been a common form of money in numerous cultures in numerous eras of history.

Of all the elements on the periodic table, gold has proven to be the one most suited to being used as money. It is durable, divisible and easily transported and stored. It is abundant enough to be able to be used as money while being scarce enough to mean new supply is not easily created.

Silver shares a lot of the monetary properties of gold. Silver has also been commonly used as money throughout history. The major downside of silver compared to gold is that it is less scarce, meaning supply is easily inflated if the value increases.

Throughout much of human history from the Romans to the modern era both gold and silver circulated together as money in a system known as bimetallism.

Gold was used by the wealthy primarily for large transactions, while silver was the money for day to day small exchanges.

This worked well on one level because it meant all manner of transactions including the small ones could be done with precious metal coins.

But it had one critical flaw.

Under a bimetallic standard, governments fix the ratio of gold to silver. The flaw is that the fixing of the exchange rate never quite matches the actual market exchange rate of the two metals.

The market gold/silver ratio is constantly in flux based on supply and demand. So even if a government was able to fix it perfectly at a point in time, inevitably the market rate would move away from the fixed rate and it would require constant re-evaluation.

This then brings into play a phenomenon called Gresham’s Law. When a government fixes the gold/silver ratio one of the metals becomes overvalued compared to the market rate and one becomes undervalued compared to the market rate.

People will then spend the overvalued metal and either hoard or send overseas the undervalued one, removing it from circulation.

Gresham’s Law is often summarised as “bad money drives out good.”

For example in 1717 Sir Isaac Newton, when he was Master of the Mint, fixed the gold/silver ratio in Great Britain such that gold was slightly overvalued and silver slightly undervalued compared to the rest of Europe.

This led to outflows of silver and inflows of gold. British merchants would pay foreigners for imports with silver because their purchasing power was better in foreign markets where silver was more attractively valued. Likewise the British would sell their exports for gold since gold was more highly valued domestically.

In 1792 the US established a bimetallic standard of 15:1, which was close to the actual market rate. However, new supplies of silver shifted the market rate over time. This devalued the market rate of silver, meaning the fixed rate of 15:1 overvalued it.

So in 1834 the US government made an adjustment and changed the rate to 16:1. This has the reverse effect of undervaluing silver and overvaluing gold and the market rate was about 15 1/2 :1.

This put both Great Britain and the US onto a de facto gold standard as their fixed ratios both overvalued gold. While formally their governments recognised a bimetallic standard at a fixed rate, Gresham’s law meant the undervalued silver disappeared. This meant gold was effectively the standard.

Great Britain wisely recognised this reality and discontinued the bimetallic standard in 1816, with the country put formally on the gold standard.

The US followed in 1873, abandoning the bimetallic standard and becoming a gold standard nation. Although this was not fully enshrined in law until 1900.

The newly formed country of Germany also adopted the gold standard in 1873.

Britain was the dominant world power in the 19th century and its gold standard had helped it rise to political and economic dominance. As other powers adopted the gold standard, hoping to emulate Britain, this had a snowball effect and more and more countries followed suit.

By 1912, 49 countries were on the gold standard. Those that weren’t held reserves in the major global currencies that were on the gold standard, such as the pound. This meant that those nations’ currencies were effectively tied to gold as well.

How the Classical Gold Standard Worked

The key mechanism of the classical gold standard was that nations would define their currency as worth a fixed weight in gold.

The paper money was freely convertible into gold, meaning that there was no obligation or coercion to hold government money. However, one could do so for convenience, with the right to exchange it back for the real money, gold, at any time.

For example in 1913 Britain defined her currency as £4.25 per ounce of gold. The USA defined her currency as $20.67 per ounce of gold.

This wasn’t fixing the price of gold. Rather this was fixing the price of paper currency relative to gold by defining it as a fixed weight of gold.

Gold has a very small stock to flow ratio. This means that the amount of new gold production (flow) being added to the existing stock every year is quite small. This is one of the reasons that had has always been sound money because it is very difficult to increase the supply of gold.

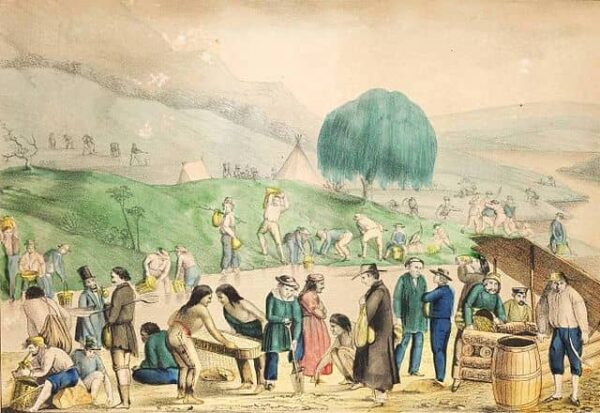

Of course if there were significant discoveries of gold, such as in California and Australia in the 1850s, the increase in gold supply and thus the money supply could make prices volatile in the short term. But in the long term prices were very stable.

Because governments fixed their currencies to gold, this in turn meant the exchange rates between currencies too was fixed.

No government manipulation was required to maintain a fixed exchange rate. Instead the natural consequence of each country fixing to gold meant that one could then easily calculate the exchange rate between two currencies.

Using the previous example of £4.25 per ounce of gold in Britain and $20.67 per ounce of gold in the US, the exchange rate between the two would be $4.86 per British Pound.

While this was the theory, in reality the market exchange rates between currencies did move away from the fixed rate. However, there was a something called the price-specie flow mechanism which kept everything in balance.

Michael D. Bordo explains:

“Suppose that a technological innovation brought about faster real economic growth in the United States. Because the supply of money (gold) essentially was fixed in the short run, U.S. prices fell. Prices of U.S. exports then fell relative to the prices of imports. This caused the British to demand more U.S. exports and Americans to demand fewer imports. A U.S. balance-of-payments surplus was created, causing gold (specie) to flow from the United Kingdom to the United States. The gold inflow increased the U.S. money supply, reversing the initial fall in prices. In the United Kingdom, the gold outflow reduced the money supply and, hence, lowered the price level. The net result was balanced prices among countries.”

For this to work effectively central banks were supposed to raise and lower interest rates to allow gold to flow in and out as necessary in what was known as “the rules of the game.”

Bordo continues:

“The classical model of central bank behavior was the Bank of England, which played by the rules over much of the 1870-1914 period. Whenever Great Britain faced a balance-of-payments deficit and the Bank of England saw its gold reserves declining, it raised “bank rate,” the rate of interest at which it was willing to discount money market paper. By causing other interest rates to rise, the rise in bank rate was supposed to produce a reduction in holdings of inventories and a curtailment of other investment expenditures. The reduction in investment expenditures would then lead to a reduction in overall domestic spending and a fall in the price level, At the same time, the rise in bank rate would stem any short-term capital outflow and attract short-term funds from abroad.”

Unfortunately while Britain was prepared to play by the rules of the game, other nations did not always do so, most notably Belgium and France.

Yet despite these breaches of the rules, Bordo argues it should be put into perspective given governments didn’t engage in widespread debasement or manipulation of the currency.

On the whole the classical gold standard worked very well and is probably the best monetary system history has yet experienced.

The Abandonment of the Classical Gold Standard

History books often say that the classical gold standard collapsed.

But it didn’t collapse. It was ended voluntarily.

The classical gold standard was abandoned in 1914 when World War One broke out in Europe.

Governments did not want to raise taxes on their citizens and so decided to finance the war through the printing press instead. That way the costs would be borne in the future through an inflation tax.

Had the costs been immediately felt, perhaps the citizens would not have been so supportive of the war.

The fact that the gold standard could just be abandoned like that at the whim of governments shows its key flaw – it was centralised and managed by the state.

Joseph T. Salerno describes the centralisation of the system:

“Under this system, the central bank generally holds the ultimate cash reserve—in this case, gold—for the entire national banking system. The gold reserve serves as immediate backing for the central bank’s note and deposit liabilities which, in turn, constitute the reserve base for the notes and deposits of commercial banks. The latter are held, along with central bank notes and gold itself, in the money balances of the public. Since both the central bank and the commercial banks hold fractional reserves against their liabilities, the money and credit structure of the economy resembles an inverted pyramid, with a relatively narrow base of gold reserves supporting a much larger superstructure of bank notes and deposits ultimately convertible into gold.”

It really is a tragedy when you stop to think about it. The best monetary system history has ever seen was ended in order to fight the most destructive war history had ever seen.

Would We Go Back To The Classical Gold Standard Today?

In theory we could go back to something like the classical gold standard today. There has even been talk that Russia and the BRICS nations are considering it.

But if and when the current fiat system ends, a gold standard would be unlikely to be policy-makers first choice.

It’s likely they would try to reset the fiat system with either CBDCs (central bank digital currencies) or SDRs (IMF special drawing rights).

Only if that failed and it looked like the public was losing confidence in the monetary system would a return to gold be on the table.

But even then, in a centralised system managed by the government, its success is entirely dependent on the competence of the policy makers.

And ultimately there is no guarantee it would not be abandoned again sometime in the future.

Salerno cautions us against trying to reinstate the classical gold standard:

“There is no compelling reason to believe that the classical gold standard will prove to be a more durable barrier to political manipulation of the money supply the second time around than it was the first time.”

Conclusion

The classical gold standard was a glorious era from the 1870s to 1914. It was a time of significant economic and human freedom and major industrial and technological advancement.

Nations defined their currencies in fixed weights of gold and therefore gold acted as the world’s money and a global standard.

It was still a government managed system and this introduced several flaws. The primary flaw was that this government control allowed them to abandon the standard when it was convenient for them, which they did at the onset of World War One.

Nevertheless there are lessons we can learn from the emergence, the operation and the failure of the classical gold standard.

It is important for any student of monetary history to understand this period.

Sources

Bordo, Michael D. 1981. “The Classical Gold Standard: Some Lessons for Today.” Review 63.

Redish, Angela. 1990. “The Evolution of the Gold Standard in England.” The Journal of Economic History 50 (4): 789–805.

Salerno, Joseph. 2016. Money, Sound and Unsound. Ludwig von Mises Institute.

Image Credits

$10 Eagle is in the public domain

$5 Half Eagle is in the public domain

$2.50 Quarter Eagle is in the public domain

California Gold Diggers is in the public domain