Disclaimer

This article is for informational and educational purposes only and does not constitute financial advice. The author may hold positions in the assets discussed. Any discussion on jurisdiction, exchanges or custody providers reflect the author's personal views and experiences and is not a personal recommendation. Always do your own research and seek professional guidance before making investment or custody decisions.

Last Updated on September 23, 2025

The best precious metal to invest in depends on your goals.

Many, choose to invest in precious metals because they are hard assets with limited supply and therefore offer long term protection against inflation and the devaluation of fiat currencies.

However, each precious metal has a different balance of industrial, jewellery and monetary demand and comes with different supply dynamics.

Some precious metals have deep liquid markets, while others have tiny markets where trading is challenging.

Gold is the most stable, most liquid and has the best monetary properties of all the precious metals. It arguably deserves a place in any portfolio.

Silver also has a massive liquid market but is much more volatile. However, its upside potential is much higher than gold and there this volatility can be your friend if you can time an explosive move upwards.

Then there is platinum, which is the most liquid alternative to gold and silver. Platinum is 30x rarer than gold and is a sound choice for diversifying your precious metals holdings away from the two traditional options.

Finally there are the rest of the platinum group metals (PGMs). Along with platinum, the PGMs are palladium, rhodium, ruthenium, iridium and osmium.

Investing in these precious metals is a bit of a challenge and a bit of a novelty. However, given their scarcity, they all have the potential for significant price movements.

If you are an experienced and well diversified investor, for whom liquidity is not such an issue, then it might be worth considering these rarer precious metals. Just make sure you consider your position size and be careful not to overdo it.

If you are a beginner then gold and silver are the place to start.

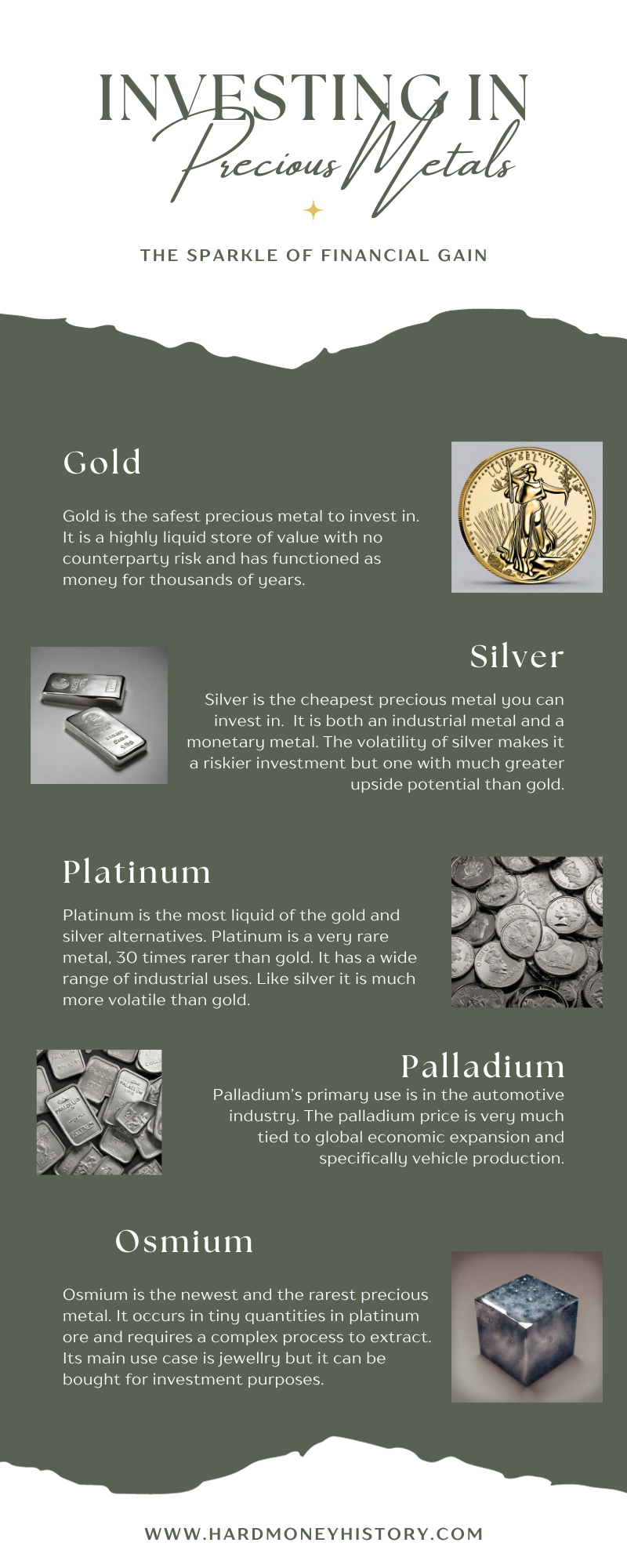

Gold: The Safest Precious Metal To Invest In

The primary investment case for gold is protection from the devaluation of fiat currencies.

It is essentially an insurance policy against any volatility or shock in the financial system.

It is a highly liquid store of value with no counterparty risk and has functioned as money for thousands of years.

The price of gold does fluctuate in the short term and medium term. The short term price is driven by the strength of the US Dollar, the inflation rate, real interest rates and the demand for gold.

However, in the long run, the trend for gold has clearly been up. Since 1971 when national currencies became fully fiat with no ties to gold, gold has appreciated in price as national currencies have weakened.

Recommended allocations to gold vary. Some staunch gold bugs might recommend 20% allocation to gold but a more conservative allocation would be 5-10%.

Silver: The Cheapest Precious Metal To Invest In

“Silver gained its special status as currency in the ancient world because it was valuable; it remained the key medium of exchange for centuries because it never became too valuable.”

– William Silber

Silver is a monetary precious metal, like gold, with similar characteristics. Silver has been used as money for thousands of years. Since it is more abundant than gold, for much of history, it was more widely used as money.

As William Silber notes, it is scarce, but not too scarce that put it out of the reach of ordinary people.

Things changed in the late 19th century as the developed economies abandoned silver as money and moved onto the classical gold standard. At that point, silver became demonetised.

This is important because while silver is historically a monetary metal, it has no official monetary status today.

On the other hand, gold still performs a monetary role in the current system as central bank reserves. Fiat currencies may not be convertible into gold but the presence of gold reserves provides stability to the global monetary system.

So why would you invest in silver when you could invest in gold?

The short answer is that it is cheaper per unit and it is more volatile. If you are not able to buy a full ounce of gold, you can probably afford several ounces of silver.

The volatility of silver makes it a riskier investment but one with much greater upside potential.

Gold is quite stable, whereas silver can be explosive. Silver outperformed gold in both the 1970s inflation and the Global Financial Crisis.

Platinum: The Most Liquid Precious Metal of the Gold/Silver Alternatives

When people want to invest in precious metals but want to go beyond gold and silver and diversify, platinum is normally the first choice.

Of the six precious metals that make up the platinum group metals, platinum itself is the most accessible and the most liquid.

Platinum is a very rare metal, 30 times rarer than gold. It has a wide range of industrial uses with significant demand also coming from jewellery and investment.

Over 70% of global platinum supply comes South Africa. Russia is the second largest producer with 12%. This makes platinum vulnerable to supply shocks that arise from volatility in those countries.

The price of platinum is primarily driven by industrial demand. However, with so much supply concentrated in one somewhat volatile country, there can be occasional supply shocks that can drive the price of platinum to the upside.

If you look at a chart of platinum you will notice that it does also tend to somewhat follow what is happening in the gold and silver markets.

Is platinum a better investment than gold?

Well, that would depend upon your investment objectives.

There were massive bull markets in the 1970s and 2000s. Although, because of its industrial use, platinum tends to crash harder during a crisis, however, it outperforms gold immediately before and immediately after a financial crisis.

Palladium: The Precious Metal Most Tied To The Health of the Global Economy

Palladium’s primary use is in the automotive industry. It is specifically used for catalytic convertors, which reduce emissions in internal combustion engines.

In fact, this automotive use accounts for 75% of the demand for palladium and they can’t produce cars without it.

What this means is that the palladium price is very much tied to global economic expansion and specifically vehicle production.

A booming economy producing a lot of new cars will support the palladium price. A slowing economy with less vehicle production will likely see a fall in the palladium price.

Like platinum, palladium is primarily supplied by South Africa and Russia, which also makes it vulnerable to supply shocks caused by volatility in those countries.

Rhodium: The Most Expensive Precious Metal

Rhodium prices are insane.

From $640/oz in August 2016, the price exploded to $28,466 in April 2021 before falling back to $14,316 in September 2022.

That makes rhodium the most expensive precious metal per ounce by a significant margin, even after a 50% retracement.

This price volatility is primarily caused by the fact that rhodium is a by-product of platinum mining. There are no rhodium mines in the world and therefore increases in demand and thus price do not result in increased supply as would normally be the case.

Since it is a by-product of platinum mining it also mainly comes from South Africa and so it is also exposed to supply volatility. Similar to palladium, 77% of demand comes from the automotive industry, which makes its price hugely dependant on the rate of new vehicle production.

Is rhodium a good investment?

Well, the challenge with rhodium is even finding a way to invest in it.

There is some investment grade rhodium available but it is not particularly common and therefore it is not particularly liquid. Tread carefully.

Ruthenium: The Cheapest Precious Metal After Silver

Silver is far and away the cheapest precious metal, spending the last 50 years in single or double digits.

Ruthenium is the next cheapest as it has spent recent history in the double or triple digits. Ruthenium has never breached $1000/oz, its all time high was in 2007 when it spiked briefly above $800/oz.

In theory, this would make ruthenium a good option after silver if you only had a small amount to invest and you wanted to buy a 1oz coin with a low premium for less than the price of platinum or gold.

The problem is that ruthenium, like rhodium, is incredibly rare with a tiny market that is not that easy to access.

Iridium: The Best Precious Metal For A Hydrogen Play

Like the other platinum group metals, iridium is a by-product of platinum mining and therefore the majority of production comes from South Africa and Russia.

It is extremely rare and there is no easy way to increase supply when price takes off. It also is a very small illiquid market and very difficult to invest in.

The key investment thesis for iridium is a play on the growth of the hydrogen economy.

Hydrogen is touted as potential green energy source as it is more easily stored and transported than other green options. Iridium will be needed as the anode catalyst.

If hydrogen doesn’t take off then there is a good chance the price of iridium will fall. On the other hand, if hydrogen gains in popularity then it is likely the iridium price will rise.

Osmium: The Newest and Rarest Precious Metal

Osmium is the rarest precious metal. It occurs in tiny quantities in platinum ore and requires a complex process to extract.

Osmium was discovered over 200 years ago but is toxic in its raw state. It was only as recently as 2013 that the crystallisation process was perfected by a company in Switzerland and Germany, the Osmium Institute.

In its crystallised form, osmium is available for use in jewellery and as an investment metal.

There are no major industrial uses for osmium. Therefore the investment case is based purely on jewellery.

The bet is that the use of osmium in jewellery will continue to rise and, due to its incredibly scarcity, jewellers in the future will be forced to pay increasing prices to access osmium and investors will be able to sell into this market.

Conclusion

The best precious metal to invest in is the one that allows you to achieve your goals.

Are you looking for safety and security?

Or are you looking for a potentially explosive move by speculating in a small market?

Precious metals investing has it all.

You have the monetary metals, gold and silver and the industrial metals, platinum, palladium, ruthenium, rhodium and iridium.

And then you have osmium, the newest investable precious metal which has a potentially explosive future as scarcity and wider adoption push the price up.

Image Credits

Gold and Silver Philharmonic by Zlataky on Unsplash

Gold Krugerrand by Zlataky on Unsplash

Silver Kookaburra by Zlataky on Unsplash