Last Updated on August 8, 2024

Benjamin Graham’s value investing principles are timeless.

Known as the “father of value investing” Benjamin Graham revolutionised the investing landscape with his simple yet ground breaking ideas such as the margin of safety and Mr. Market.

His book The Intelligent Investor is a classic that is still a must read for any value investor today.

Who Was Benjamin Graham?

Benjamin Graham was born in London in 1894.

He moved to New York as a child with his family. Sadly his family lost their savings in the panic of 1907.

He graduated from Columbia in 1914 and took a job on Wall Street. In 1926 he went into partnership with Jerome Newman, forming the Graham-Newman partnership.

This was initially a success in the boom years of 1926 to 1929.

But from 1929 to 1932 Graham’s fund lost 70%.

Graham was mentally scarred from the experience but learned some massive lessons about investing and survival.

By 1934 he was teaching at Columbia with David Dodd and they co-authored the seminal work Security Analysis.

15 years later in 1949 he published The Intelligent Investor.

What Is Value Investing?

Benjamin Graham is the pioneer of value investing.

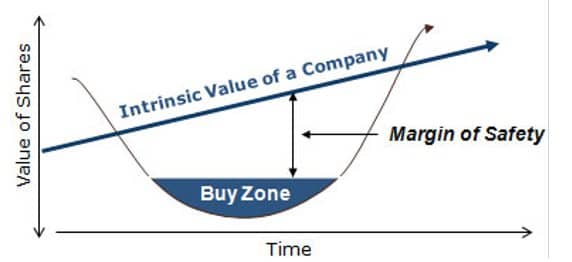

Value investing is based on the concept of buying stocks below their “intrinsic or fundamental value.”

The idea is that the market is mispricing those stocks and they are trading at a discount.

By identifying undervalued stocks, a value investor hopes to achieve capital growth as the market reprices the assets to reflect their fundamental value.

What Are Benjamin Graham’s Value Investing Principles?

All of Benjamin Graham’s ideas can really be boiled down to the following two principles:

- Don’t Fear Volatility, Benefit From It

- Make Sure You Invest With A Margin of Safety

Graham argues that the markets will be irrational and volatile at times, sometimes being wildly overvalued and sometimes being wildly undervalued.

The job of an investor, he argues, is to accurately calculate the intrinsic value of a company and buy when the market is pricing it at a significant discount.

That way if you are wrong, or even just temporarily wrong, you will limit your downside and hence you will buy will a margin of safety.

What Are Benjamin Graham’s Books?

Security Analysis was a 1934 book co-authored by David Dodd when Benjamin Graham was teaching at Columbia.

It introduced the key ideas of intrinsic value and the margin of safety.

Remember the United States and the world were still recovering from the aftermath of the speculative mania of the 1920s.

The stock market was seen by many as a casino and a place for speculation. You might get rich or you might lose it all.

Graham introduced concepts that seem simple today but were novel then – that the stock market was a place to buy and sell ownership in companies but that price did not always equal value.

The Intelligent Investor is Benjamin Graham’s most famous work and is considered to be a must read book for any investor.

It built on the ideas put forth in his first book but also introduced Graham’s famous character Mr. Market.

Mr. Market is the irrational business partner that everyday offers to buy you out of your holdings.

Some days he quotes crazy high prices and on other days he quotes crazy low prices.

Graham’s advice is to ignore the irrational Mr. Market and focus on holding good businesses with solid fundamentals and only take advantage of him when you want to sell and he offers you a good price.

What Is Benjamin Graham’s Legacy?

Benjamin Graham’s legacy comes from the pioneering concepts that have stood the test of time.

However, perhaps his more famous legacy is from his student Warren Buffett who has gone on to become the most famous value investor in the world.

Buffett credits Benjamin Graham’s teachings as having an enormous impact on his investing philosophy and ultimately his success.

22 Things I Learned From Benjamin Graham’s Value Investing Principles

I first read Graham’s book The Intelligent Investor in 2017, after seeing it recommended by several commentators and newsletter writers that I followed.

I’m glad I read it when I did, as at least I had some investing experience by then.

I think it did more good for me then than if I had been a total beginner, where some of it would have been lost on me.

I wouldn’t say I was completely blown away.

But I think that was primarily because many of the the investors and commentators that I followed subscribed to Graham’s philosophy, so I had already imbibed much of that thinking.

Still, it did have an impact on me and crystallised some important concepts.

There is something about taking the time to read a book over a number of days or weeks that helps important ideas settle deep within your psyche, rather than the cursory exposure you get from reading a short article such as this.

Nevertheless, here are the key things I learned from Benjamin Graham about value investing in a quick and easy to read format.

But seriously, read the books if you want to really absorb the lessons.

1. Think Like an Owner

When you purchase a stock you are purchasing an “ownership interest” in that business. That may seem self-evident, but many people buy stocks thinking only of the price and hoping they will be able to sell one day at a higher price. They don’t think about the underlying business.

You can simplify matters and provide some much-needed mental discipline when you think like an owner and apply business like principles to your investing.

Think about whether the business you are buying into is a sound, profitable business that is likely to succeed in many years to come.

Is this something you would be happy to purchase as an owner-operator?

Think about whether it is available at a reasonable price. Don’t expect wild profits but consider the normal growth in value and dividend payments that would be expected in the ordinary course of profitable business.

2. Speculation is Not Investment

Graham defines an investment as something “which upon thorough analysis promises safety of principal and an adequate return.” He considers everything else to be speculative.

A lot of people think Graham was opposed to speculation but he clearly acknowledges that there is nothing wrong with it. He also notes that just like investing, speculation can be done either intelligently or unintelligently. To him, the key thing is that you do not confuse it with investing.

Investing accepts some risk but focuses on mitigating that risk, protecting the downside and generating an adequate but not an outsized return.

Speculation aims to deliver outsized returns but often takes on more risk to do so.

I don’t actually agree with Graham on this point. I think everything is speculation. Nevertheless there is a lesson in mindset that Graham is teaching here. He is making a distinction between investment with careful analysis and lower risk and investment with limited analysis and higher risk.

I am someone who gladly speculates. But I do so through a Benjamin Graham lens. Even though I think everything is speculation, I have really benefited from Graham’s sharp delineation between the two as it is important to be clear in your mind what you are trying to achieve every time you purchase an asset.

3. Know Whether You Are an Enterprising or Defensive Investor

Graham identifies two categories of investor – enterprising or defensive.

This is not a question of how much risk you are willing to take, but rather how much time and energy you are willing to take on the selection of stocks.

The idea is that as an enterprising investor you would be rewarded for your efforts with a higher return.

But for someone who doesn’t have the inclination for stock selection or doesn’t want the hassle, defensive options will be more suitable.

Both enterprising and defensive investors are still investors. Both will follow the same principles according to Graham.

But it helps if you reflect on which one you are.

If you don’t want to put a lot of time into choosing stocks and monitoring your portfolio then you may want to be more defensive in your choices.

4. Don’t Lose Money

Graham notes that the chief emphasis of the intelligent investor should be to avoid serious loss.

His most famous student Warren Buffett has immortalized this belief with his catch phrase, “Rule number 1 is don’t lose money. Rule number 2 is don’t forget rule number 1.”

Small losses will be inevitable (and hopefully temporary), as you cannot pick a market bottom with any certainty.

But it is imperative to avoid significant catastrophic losses.

Consider this:

If you invest $10,000 into a stock and it loses 50%, what return does it need to generate in order to return to the original invested amount?

It’s not 50% as many people mistakenly think. A 50% loss on $10,000 is $5000. A 50% gain on $5000 is $7500.

The return you need on a 50% to just to break even is 100%.

It is a sobering thought to realise that you need outsized gains to offset losses. This should illuminate just how disastrous a loss can be.

It may be better to accept a safer investment with a smaller rate of return than to take the risky option and lose.

5. Be Contrarian

I’m not aware that Graham ever described himself as a contrarian and, while I’m sure many people would disagree with me, I think his philosophy lends itself to the contrarian view.

He argues that there is no point trying to identify stocks that are going to do better in the short run. Partly because it does not fit the temperament of a buy and hold investor, but because you would end up competing against better resourced and educated financial analysts on Wall Street who are trying to do the same thing.

“We are thus led to the following logical, if disconcerting conclusion: To enjoy a reasonable chance for continued better than average results, the investor must follow policies which are (1) inherently sound and promising, and (2) not popular on Wall Street.”

When you instead buy stocks when they are attractively valued, chances are they are not the current hot stock or next big thing or else they would probably be over rather than under valued.

To buy something that is out of fashion requires a contrarian mindset. Be prepared to buy what no one else wants. Don’t FOMO in at the top when an asset is overvalued.

6. Take The Long View

A lot of people get into trading as a way to make quick money and instead they often lose a lot.

I’m not against trading, as it works for some, but it doesn’t work for me and it doesn’t align with the Graham philosophy.

Graham advocates a buy and hold strategy. He suggests you buy a stock when it is attractively valued and sell it when it is overvalued.

This sounds simple but it requires patience and the willingness to hold a stock for a long time instead of chasing momentum or short term price fluctuations.

This is easier on one hand, as you don’t have to constantly check the price or execute frequent trades.

But it can be quite challenging on the other hand is there can be a constant temptation to sell when in profit, when even greater profits lie ahead.

7. Learn From Your Mistakes

Jason Zweig, who provides commentary on the revised edition of Benjamin Grahams famous book The Intelligent Investor notes that Graham lost an eye watering 70% during the period 1929-1932.

Surely he could have packed it in at that stage and got out of investing. But he stuck at it, picking up bargains during the subsequent recovery and going on to be one of the most famous investors of all time.

If you have suffered investment losses, as we all have and all will, don’t lose heart. Learn from your mistakes but pick yourself up and carry on.

8. Price and Value Are Not The Same Thing

Benjamin Graham is known as the father of value investing. Value investing is when you buy stocks that are priced at or below the tangible asset value of the company.

This is in contrast to so-called growth stocks, where the stock price of the company far outstrips the actual value of their tangible assets, because investors expect future growth to continue to drive the stock price higher.

Value investors aim to purchase a company when the stock price is lower than the actual value of the company in the view that the stock price will eventually appreciate to match the real value of the company.

It’s not always the case but so-called growth stocks tend to be things with a lot of hype such as Tesla, while value stocks are more likely to be boring companies who steadily provide for societies everyday needs such as supermarkets or utility companies.

I do not slavishly follow the principles of value investing all the time and am happy to buy the odd growth stock. But my primary mentality is one of value investing and the lens that Graham provides.

Every investor can benefit from understanding Benjamin Graham’s distinction between price and value.

9. Buy Quality Stocks Not Just Cheap Ones

A mistake when it comes to value investing is to think only about buying something on the cheap. Buying something cheaply is no good if the underlying business is also no good.

Some things are cheap for a reason.

“Observation over many years has taught us that the chief losses to investors come from the purchase of low-quality securities at times of favourable business conditions.”

Graham’s message is that you want to look for a desirable business with good prospects that is cheap relative to the inherent value of the company.

It must be cheap but it also must be high quality. Don’t get so blinkered by the former that you forget about the latter.

High quality means a satisfactory P/E ratio, a strong financial position and likelihood that its earnings will at the very least be maintained in the future.

10. Buy with a margin of safety

One of Graham’s most famous ideas is that of the “margin of safety.”

Every investor can be wrong at times and will suffer loss. The concept of the margin of safety is to protect yourself against catastrophic loss.

If you buy a so-called growth stock trading at many times its earnings multiples then there is significant risk that the stock price may decline – there is no margin of safety.

An undervalued stock may still decline, but if it is already undervalued and it is a sound business then there is a limit to how much it can decline.

The margin of safety is designed “for absorbing the effect of miscalculation or worse than average luck.”

If you buy something that is overvalued, the only way you will make any money from it is if you sell it to someone who is willing to buy it at an even more overvalued price, or if over time the company grows such that its fair value eventually meets the price that you paid.

However you can save yourself the risk and generate a safer and more reliable return if you purchase an undervalued company with a margin of safety.

Not that Graham would ever advise it, but you can also save yourself some risk by looking at the technical indicators that might suggest that the bottom is in.

11. Mr. Market

Another of Benjamin Graham’s famous contributions to value investing literature is the idea of Mr. Market.

Graham asks you to imagine yourself in business with a partner called Mr. Market. Mr. Market is emotional and irrational and everyday he offers to either buy you out or sell you his share.

The thing is, he changes his mind everyday as to what price he will offer. Some days he is entirely reasonable and on others the price he quotes is extremely high or very low.

As an investor who thinks like an owner, the stock market is like this crazy business partner of yours who throws wild price quotes around on a daily basis. Sometimes they are high, sometimes they are low and sometimes they are appropriate.

In private business, you would ignore the offers of Mr. Market and carry on with providing your goods and services, knowing that you are building a profitable business and generating an income.

Graham argues that stock market investing is no different.

Assuming you have entered at an attractive price, you can ignore the crazy price fluctuations knowing that the underlying business is sound and just collect your dividends.

Where Mr. Market comes in handy are the rare times where you want to buy and sell.

If you are patient, one day he will give you an attractive and cheap entry point. And likewise one day he will give you an attractive and expensive exit point.

At all times in between you can safely ignore him.

12. The Importance of Diversification

If you could easily pick winners all the time then diversification would be unnecessary. But since no one can reliably pick winners all the time, diversification is necessary to protect you against loss.

Graham puts diversification in the same basket as his concept of the margin of safety. You can do all your homework on a stock and it may seem like a winner but you may be wrong.

So you have to be humble and recognise that you may be wrong and spread your eggs over more than one basket.

But don’t spread yourself too thin or diversify for diversification’s sake. Graham thinks adequate but not excessive diversification is between 10 and 30 stocks.

13. As a Retail Investor You Have an Advantage Over The Professionals

“The true investor scarcely ever is forced to sell his shares and…he is free to disregard the current price quotation.”

This is one of the most important lessons I have learned from Benjamin Graham. I never have to sell my shares. I also never have to report my position to clients.

This is unlike professional money managers who might report monthly and constantly have to trim their positions to avoid short term loss. They also can’t afford to be too wrong when entering a position in case it declines first before it rises.

As a retail investor with the luxury of never having to sell, you can get the entry point slightly wrong in the short term and you can ride the wild fluctuations in the market without too much worry about the price.

14. Learn to value a company

The key to Benjamin Graham’s investment thesis is that the business valuation of a company and the stock market valuation are often markedly different.

The true value of a company is subjective and the stock market price reflects what the market is willing to pay at any given time.

But you should attempt to value the business based on its assets and earnings to determine whether the stock market price is fairly valued or not.

To do so, you will need to learn to read a company’s balance sheet.

If this is difficult because you don’t have the financial literacy, there are certain metrics you can look at like the price/book ratio, the price/earnings ratio, the EBITDA and the EPS.

There are also a number of Benjamin Graham value calculators online such as this one.

My other hack for valuation is to find an undervalued sector of the market, poised for a rebound, and then do a lot of reading and research to figure out which is the best positioned company in that sector. This saves me having to rely on my own ability to value an individual company.

15. Look at The Dividend History

Graham likes companies that have a long history of continuous dividends. Dividends are an excellent metric because they represent real earnings rather than the possibility of future growth.

Dividends give you another margin of safety, both in the regular income and in the fact that a solid dividend will always have some appeal because it represents real earnings which will likely put a floor on the price of a stock.

16. Consider The Management of The Company

This is not something I had ever thought about until I read Graham. But it makes so much sense. If, when buying a stock, you are becoming an owner, then the management of the company work for you. So you want them to be good.

Now before buying a stock, I do some research into the management. It’s generally pretty easy to find out about their background online, whether or not they are highly regarding within the industry and whether or not their previous employment was a success or failure.

It’s also a good idea to know if they own the stock and if they are buying or selling. Selling can be a red flag. Insider buying is very bullish.

17. Your Character is Important

Having a strong mindset and a strong character is important in investing.

Investing requires more than just your brain. It requires the fortitude to experience declines, the patience to wait for the market to move, the courage to hold on and the wisdom to ignore the chattering noise you hear in the financial news.

You especially need to be able to avoid getting too despondent when your positions are down or too euphoric when your positions are up.

All of this requires strength of character.

18. Be Patient

Good investors know that gains come with patience and they come with time. The investor’s goal is not to make quick money on price appreciation. Rather, it is to acquire sound companies at a good price and hold them over the long term.

There should be no rush to sell, unless Mr. Market comes along and offers you a price that is too good to refuse.

19. Remove Emotion and Use Logic

Warren Buffett, in the preface to second edition of The Intelligent Investor notes:

“To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework. This book precisely and clearly prescribes the proper framework. You must provide the emotional discipline.”

Graham doesn’t give advice as to how to control your emotions – that is outside the scope of what he is trying to communicate in his writing. However, as he and Buffett make clear, emotional control and emotional discipline is incredibly important. Investing decisions need to made on logic and reason. Emotion will cloud your judgement and lead to poor decision making.

Being aware of that is often enough and you can run every decision through a checking filter – “Is this an emotional decision or a logical one?”

20. Don’t Check the Price Too Often

There is a temptation to check the price of your stocks several times a day. While I’m sure this temptation would have been present when people checked prices in the newspapers, it has only gotten worse with the internet and worse again with the smartphone.

Graham advises you resist the temptation to check the price too often, since you should expect price fluctuations and it should not concern you. Checking the prices too often may induce you into an emotional decision.

By not checking the price too often you “will be spared the mental anguish caused…by other persons’ mistakes of judgement.”

Prices are only there as convenience provided by Mr. Market. When you are buying and selling you will take advantage of them but at other times it is best that you ignore them.

21. Start Investing Young

Graham argues that there is a significant advantage to beginning your investment journey young.

Given that you are likely to make some mistakes and take some losses, it is much better to do this when your investable income is small, especially relative to your salary.

You can take more risk, withstand greater losses and allow time to work its magic when you are young. If you don’t have any dependents then that helps too.

This is very different to if you first started investing with a large lump sum later in life where the risk of loss was greater.

It’s not a problem if you didn’t start investing until you were older. You just need to be aware that you have to be more cautious.

22. The Benjamin Graham Four Rule Stock Selection Criteria

I don’t always follow Graham’s criteria perfectly, but I feel like it is an incredibly useful mental model to help me gauge whether or not a stock is an attractive buy.

Most of these points have already been mentioned, but here they are in a handy list:

- Adequate but not excessive diversification of 10 – 30 stocks

- Large, prominent and conservatively financed companies

- A long record of continuous dividend payments

- Put a limit on the price you are willing to pay with consideration of the price/earnings ratio (Graham recommends a maximum P/E of 25)

Conclusion

Benjamin Graham is the father of value investing and the mentor of the great Warren Buffett.

In fact Buffett calls Benjamin Graham’s famous book The Intelligent Investor the best book on investing ever written.

Graham’s foundational principles are timeless but if there is anything you should takeaway it is that you should avoid paying too much for good stocks, that you should always have a margin of safety and that Mr. Market is your friend especially if you ignore him most of the time.

I also value Graham’s distinction between speculation and investment. When I speculate I am prepared to take a risk on significant price appreciation.

When I invest, I forgo the potential for rapid gains and instead look for safety first and gradual but steady gains from attractively valued companies with a sound underlying business and a good balance sheet.

If you are an investor and you haven’t read Graham then I’d suggest making it a priority.

Sources

Graham, Benjamin, Warren E Buffett, and Jason Zweig. The Intelligent Investor : The Definitive Book on Value Investing. New York: Harper Collins, 2003.

Graham, Benjamin, and David L Dodd. Security Analysis : Principles and Technique. New York: Mcgraw-Hill, 2009.

Image Credits

Businessman reading by Adeolu Eletu on Unsplash

Man in grey t-shirt by Joshua Mayoo on Unsplash

Benjamin Graham is licensed under CC-BY-SA 4.0

Margin of Safety is licensed under CC-BY-SA 4.0